The cryptomarkt crash got steam at night when his top crypto, “Bitcoin Price”, with 5.2% dropped to a low of $ 100,345. This fall was seen because of the liquidation of livered transactions, geopolitics and the Elon Musk-Donald Trump-Vete.

Keep reading, because this article sheds light on the main reasons for the overnight crash and whether the bull is over in BTC or not.

Aggregated reasons for the decrease in the bitcoin prize from yesterday

The primary reason for the deterioration was that Trump signed a new executive order, that volatility has fueled the volatility in large financial instruments, and that also influenced BTC sentiment. This time his EO thrown lightning in steel and aluminum Rates, which have risen by 50%, to promote the production of American internal factories to scale up.

Likewise, arguments with China started to warm up again and no resolution has yet been worked out between China and the US. As a result of these global pessimistic factors, the cryptomarkt went in the Bearish mode last night, the growing uncertainty is create Delays in important technological progress too.

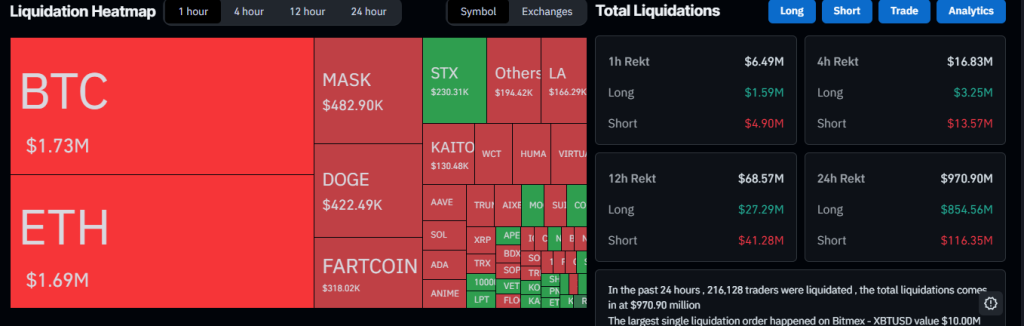

The result of the Bearish mode caused liquidations of 215,593 traders in the last 24 hours, and the total liquidations amount to $ 967.63 million, per coinglass. It said that the largest order with a few liquidation took place on Bitmex – XBTUSD, with a value of $ 10.00 million.

Therefore, if things go south and the pressure grows, the price could go as low by June as $ 92917. If things go north, however, this time $ 130k is the goal before the end of June.