While Pancakeswap leads on the Defi market, the price of cake should not yet catch up with the momentum of the platform.

With current technical progress and strategies, Pancakeswap has the potential to continue to grow, but the road remains loaded with challenges.

Pancakeswap’s turnout in the Defi market

Pancake wap, one of the decentralized exchanges (DEX) on the BNB chain, strengthens its strong position in DCentralized Finance (Defi). According to the latest data from Dune Analytics, Pancakeswap led in the market share of trade volume for the past seven days, with an impressive 66.9%.

The monthly volume of pancakeswap. Source: Defillama

Defillama does not stop and reports that the stock market has registered a monthly trade volume of up to $ 149 billion. This figure surpasses its most important competitor on Ethereum, Uniswap, who registered $ 86 billion.

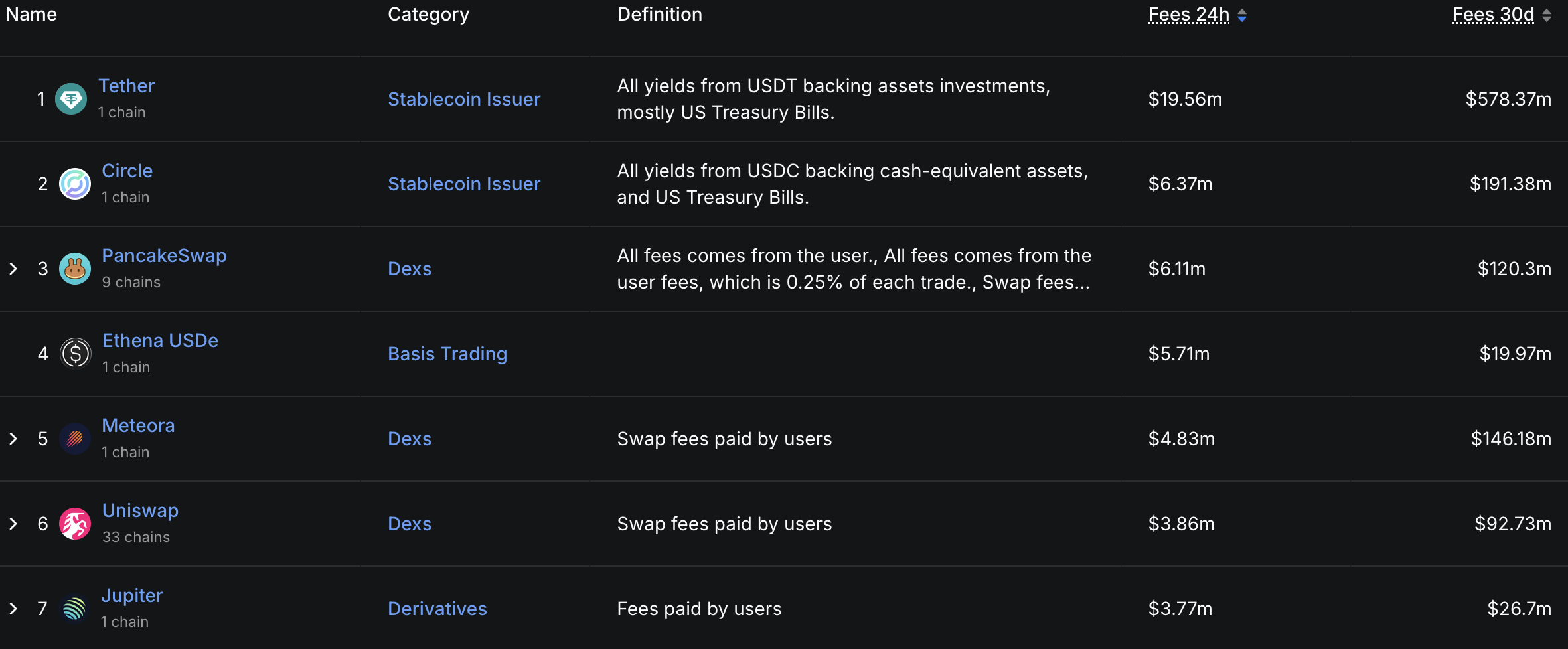

In addition, the costs of Pancakeswap have reached more than $ 120 million in the last 30 days. This has placed the platform in the top 3 and even surpassed pump. Fun, a prominent name in the Defi space.

Pancake waps costs. Source: Defillama

This remarkable growth can be attributed to recent technical improvements of Pancakeswap.

A post on X from Pancakeswap’s official account on 22 May stated that the team optimized its data acquisition mechanism with the help of an internal indexer. This dealt with the issue of delayed TVL data (total value locked) of external providers, which lasted for two weeks and influenced the optimum trade routing on Binance Wallet Swap.

After the implementation of this solution, Pancakeswap restored the optimum routing functionality and worked together with external providers to build a stronger platform, which prevent similar problems in the future. These technical improvements improved the performance, but also strengthened the user’s confidence in the platform.

In addition, the launch of the Infinity Upgrade (formerly Pancakeswap V4) has contributed considerably to the current success at the end of April 2025. This upgrade introduced capital-efficient liquidity pools, hooks and adjustable costs, which creates more favorable conditions for liquidity providers in the BNB chain.

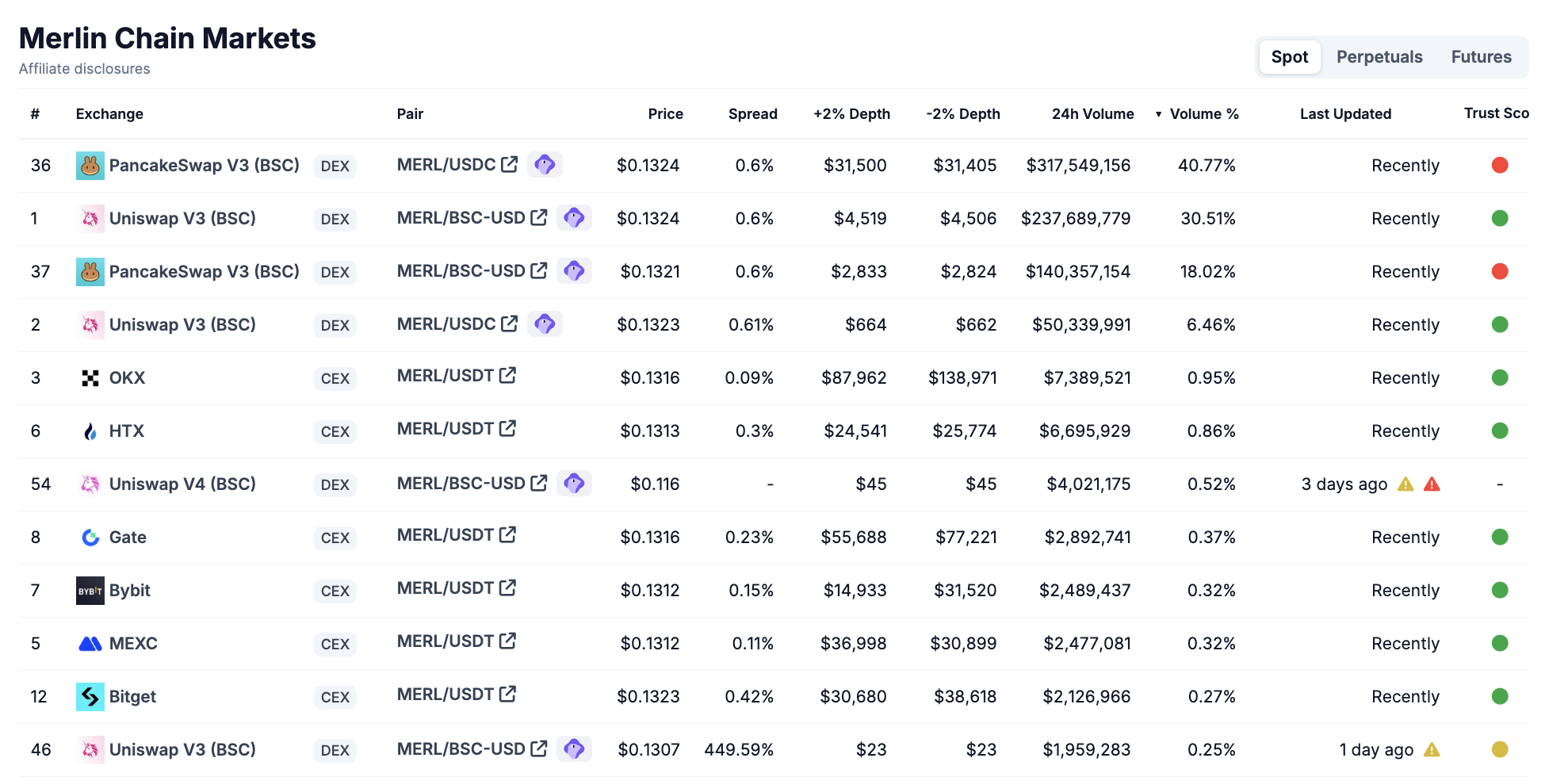

These factors have helped pancakes to attract many users and transactions, in particular with the Merl -Toking of Merlin chain, which, according to Coetecko, registered a trade volume of more than $ 409 million of more than $ 409 million. Trade volume on pancakes WAP accounts for 59%.

Merlin Chain’s trade volume. Source: Coingecko

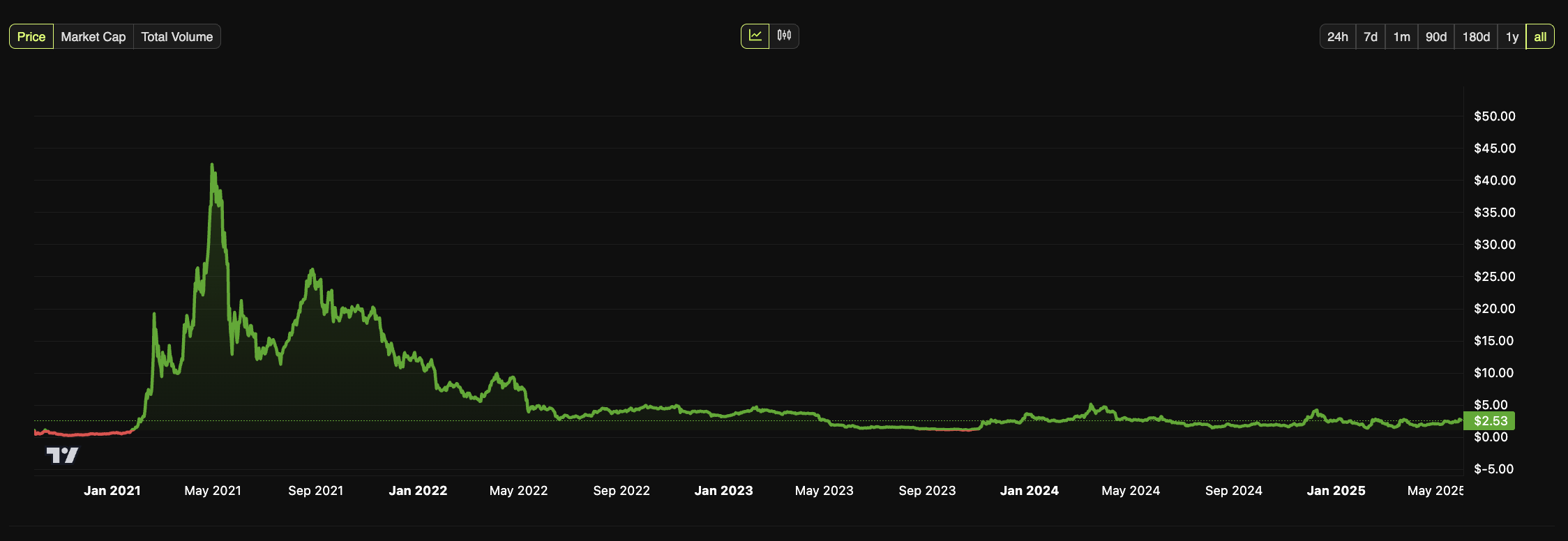

Cake price: a journey that contrasts with the performance of the platform

Despite the remarkable performance of Pancakeswap, the price of his native token, cake, sketches a less interesting image. According to Coingecko’s data, the price of Cake has fallen by 9% over the past 24 hours, while in the last 7 days they only rise slightly by 1.6%.

Cake’s price. Source: Beincrypto

Cake is currently being traded at $ 2.53, a decrease of 93.9% compared to its highest. Although the market capitalization of cake is still in 114th place on Coingecko, this price decline has questioned many investors who have questioned the long -term long -term.

However, some traders continue to trust in the long -term potential of cake. Trader Huahuayjy noticed,

“As long as Binance Alpha continues to thrive, cake will be discovered because of its value, and all transaction costs from the Alpha volume will see 30%. Cake will soon be the most profitable protocol,” a trader noticed.