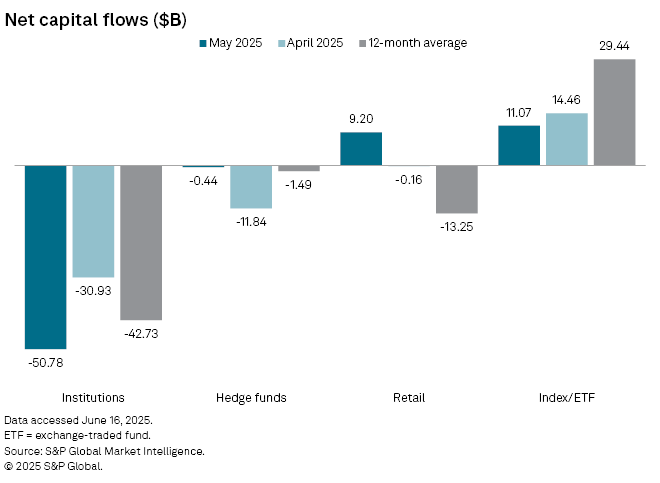

Institutional investors dumped a net $ 50.78 billion in shares in May, according to Market Intelligence of S&P Global.

That number surpassed the net $ 30.93 billion in shares that were released by institutions in April and is above the net monthly average in the past year of $ 42.73 billion.

S&P Global Notes that institutions dumped shares in May because of the concern about trade and the decision of Moody to downgrade the creditworthiness of the United States from AAA to AA1.

Explains Thomas McNamara, an S&P Global Director of Market Intelligence,

“Institutions still do not feel that we are out of the forest in relation to rates, recession and general global uncertainty.”

Conversely, the index and exchange-related fund investors spent a net $ 11.07 billion in shares last month and $ 14.46 billion in April. However, both figures are considerably less than the average of 12 months of $ 29.44 billion.

McNamara says that it is “never zero-sum” in terms of stock sales.

“There are many factors that go into this on a general basis, but this month was a main board of stock buying. This can also be a reason why the market returned as it did without any long -term conviction.”

The S&P 500 has risen by 0.25%in the past month, and the Nasdaq composite has risen almost 1.6%, although the industrial average of Dow Jones is falling by almost 1.4%.

Follow us on X” Facebook And Telegram

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Surf the Daily Hodl -Mix

Generated image: midjourney