While today’s cryptomarkt varies sideways, Ethereum has set decent movements, both on the price diagram and with news about its foundations. The health of the Altcoin shows a remarkable force. Allegedly the exchange balance has fallen constantly and have now reached their 7-year low point.

That is not all, ETH-based ETFs have avoided the ETFs of the Global Crypto Market with $ 321 million in inflow. In this analysis we give you an overview of Ethereum with $ 219 billion in capital and where the ETH price can go in the short term.

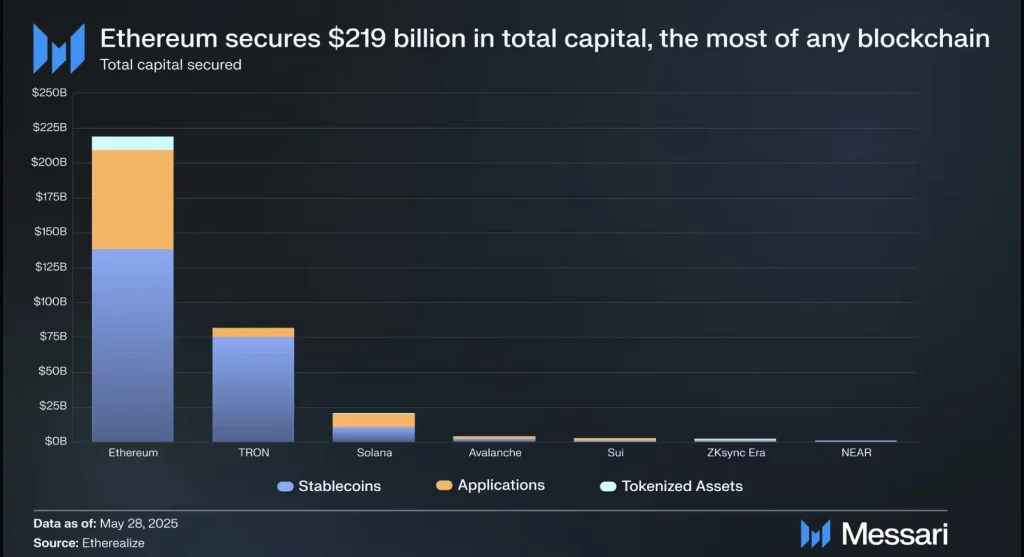

Ethereum secures $ 219 billion?

According to MessariEthereum continues to dominate the blockchain landscape, which guarantees $ 219 billion in total capital, the highest of each network. This capital includes stablecoins, applications and tokenized assets, which strengthens the position of the Altcoin as the fundamental layer of web3. The graph emphasizes how all other chains in economic weight dwarmer, with more than double the secure capital of Tron and enormously more than Solana, Avalanche and others.

The next key resistance is between $ 2,750 – $ 2,850. A decisive movement above this reach can open doors for a test of $ 3,000 in the short term. On the other hand, ETH finds solid support between $ 2,260 – $ 2,100, a zone where previous consolidations took place. Given the current strength in both Fundamentals and Technical, Ethereum seems ready for further upwards, with the exception of large macro -opposite wind.

Read our Ethereum (ETH) Price forecast 2025, 2026-2030 for long-term price goals!

FAQs

The price of 1 ETH at the time of publication is $ 2,601.69 with a change of +4.44% since yesterday.

The $ 321 million in ETF inflow means a growing institutional demand and the mainstream acceptance of Ethereum as a long-termactive.

Investors are increasingly making ETH in cold storage or expansion, which indicates long -term trust and reduced sales pressure.