Bitcoin has again taken the center of the crypto market, not only for his price that hangs around the all time, but also for the strategic movements that take place behind the scenes. Strategy has recently purchased 4,020 BTC at an estimated cost of $ 427 million, so that speculation is fueled over a potential leg. However, the market seems to be divided by views. While the price applies more than $ 109k, investors are now watching the trends on the chain, liquidation data and whale movements for instructions for the next movement.

Smart Money vs. Retail Money?

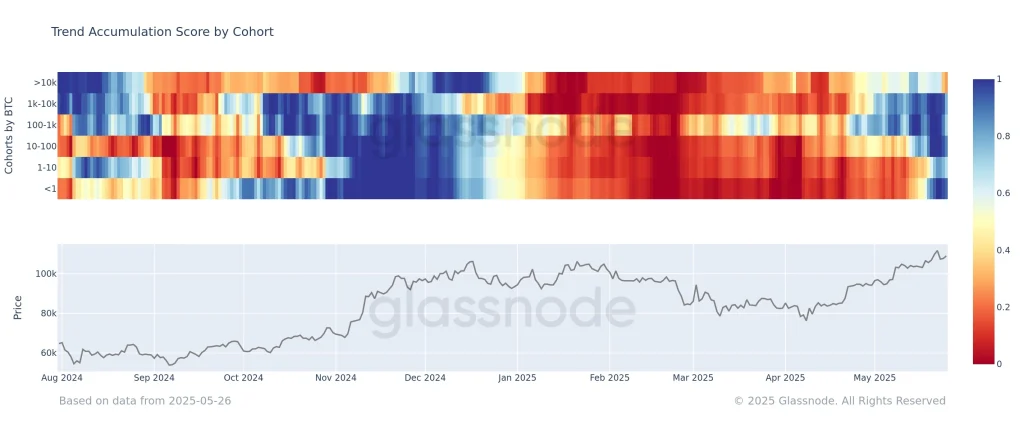

Recent insights from Glass node Unveiling a crucial shift, with the larger than 10k BTC cohort (the largest players in the market) moved to a net distribution zone with a score around 0.3. This is a clear reversal from earlier in the year, when whales were leading accumulation during price rallies.

It is to note that, above the current BTC price, short liquidation levels appear to be weak, which indicates less momentum for an upward squeeze. This correlating with the distribution by large holders paints an image where short -term volatility is not only possible, but is statistically preferred. However, it is worth quoting that such movements often reset leverage and offer stronger bases for continuation.

Bitcoin (BTC) Price analysis:

Bitcoin price today fell by 0.40% at $ 109.222.37, but still has a profit of 3.37% in the past week. Market capitalization is $ 2.17 trillion, somewhat lower day-over day, while 24-hour trade volume rose to $ 50.45 billion. The price varied between $ 107,609.56 and $ 110.376.88, with the short -term volatility. We can expect a pullback for the next ATH, which can be around $ 113k.

If you are a hodler, you now have to read our Bitcoin (BTC) price forecast 2025, 2026-2030 now!

FAQs

The Bitcoin price has now fallen a negligible 0.40% to $ 109.222.37, but the trade volume has increased by 5.77% with an inflow of $ 50.45 billion.

The most important levels to view are $ 107k – $ 109k, if BTC drops here, strong reactions can occur due to liquidation -driven volatility.