- The recent Retracement from Bitcoin led to a cautious bouncing and invited Shorts to increase their bets.

- Could this break actually be a strategic arrangement?

Bitcoin [BTC] was slipped back in his classic “wait -and -see” mode.

After a textbook racement to the psychological level of $ 100k, you would expect that bulls will come and charge with conviction. But instead, the Bounce Underwhelming has been. No explosive follow -up, no parabolic recovery.

That hesitation? It gets opportunistic shorts an opening and they have arrived. Binance’s BTC/USDT permanently Now show almost 60% short bias and showed that many traders lean at a disadvantage.

What if this subdued break is not a sign of weakness, but a deliberate strategic consolidation? A calculated set -up that lays the groundwork for an outbreak with high volatility?

Shorts strategy to take advantage of Bull Heseling

Currently, 96.6% of Bitcoin’s range is in non -realized profit. Add the fact that the short -term holder (StH) delivery Has brought itself back to levels of November 2024.

In the meantime, the retail trade remains on the sidelines, and with the construction of macro tickles for the FOMC, Capital has been turned into shares, leaving BTC’s Momentum in the balance.

In this context, the rising short bias does not seem reckless; It looks earlier, calculated as a short -leners eye, which looks like a clean reversing arrangement.

But what fuel adds to their conviction is the lack of directional momentum.

Simply put, with bulls that show hesitation and no outbreak in sight, nobody really has control now. That lack of clear direction shows the door wide open for a withdrawal, and shorts know it.

Source: Hyblock Capital

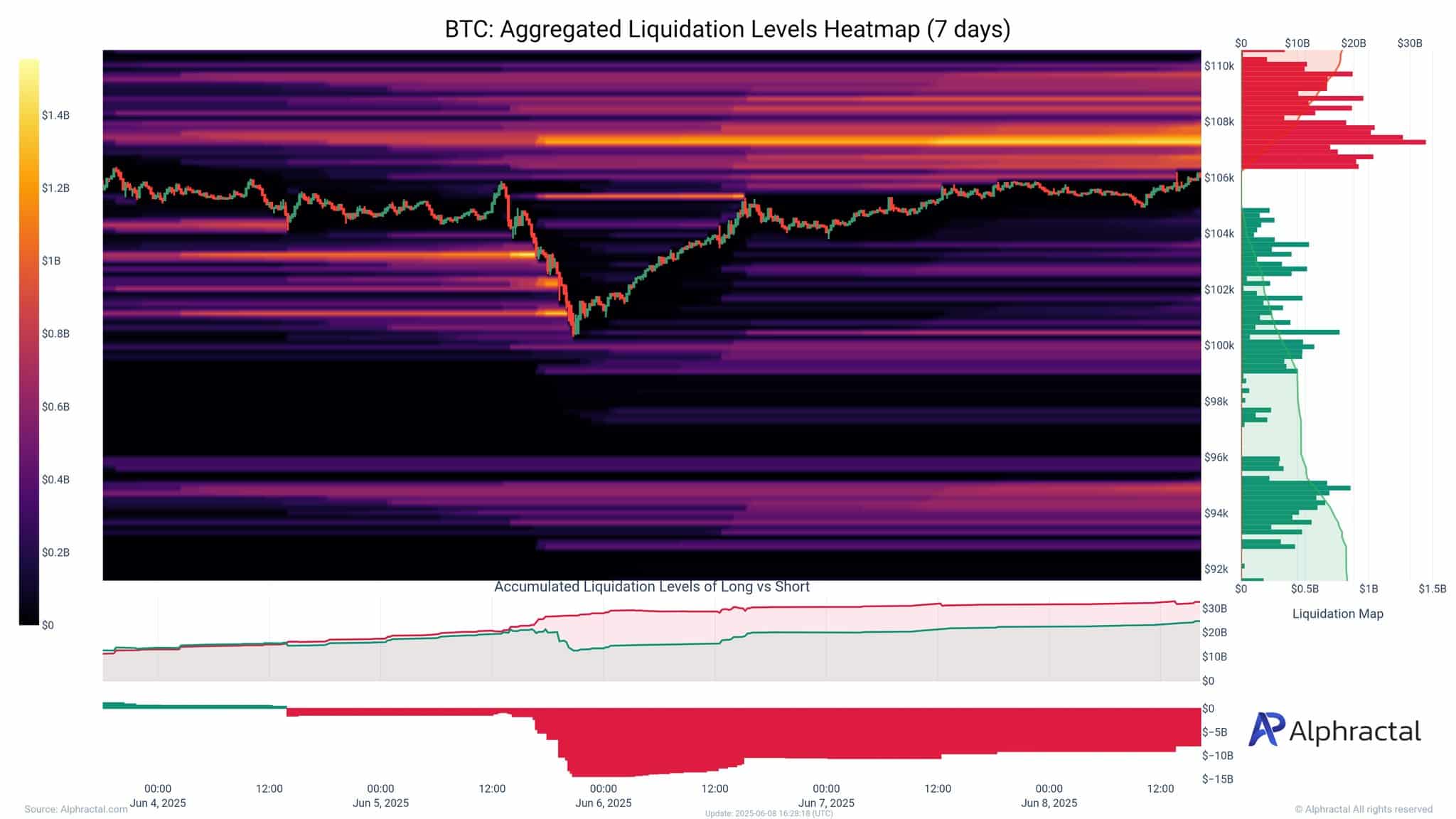

As illustrated in the graph above, Bitcoin’s weekly aggregated liquidation -Delta shows a clear red dominance, indicating that long positions are aggressively liquidated.

Consequently, this dynamic feeds a speculative bubble. Every time BTC withdraws, forced liquidations destroy traders betting on a bullish rally. Because Financing percentages prefer lungsLiquidations flow quickly in larger sale.

It is no surprise that Binance sees a heavy brief bias. As mentioned earlier, we benefit from short-sellers on Bull Heseling, making it an excellent strategy for too much return.

Market voltage peaks as Bitcoin -eyes a big short cluster

Bitcoin has now spent more than a week consolidating under $ 106k – $ 107k zone, which enhances it as a key resistance ceiling.

As a result, lungs are always washed away, and without large Institutional money If you take a step back, shorts become more confident that a correction is on the deck.

But here is the thing – every time someone adds to a short bet, they also put the stage for a pinch. That is why the longer BTC consolidates without breaking down, the more explosive the outbreak could be.

And with more than $ 1 billion in shorts that is stacked just above $ 107k, that level could work as a launch path like Bulls decide to push by.

Source: Coinglass

Interesting is that Michael Saylor seems to position for exactly that, double While reserves continue to shrink between stock markets while investors opt for cold storage.

Strong hodling behavior, confirmed by chain statisticsFurthermore, underlines the story of the supply.

Put it all together and the current consolidation of BTC does not seem like indecision. Instead, it looks like a fall set. One that could lure in more shorts before he unlocking a squeeze and higher goals.

At the moment, Hodling is perhaps the smartest step on the board.