Uniswap has marked its position company in the center of Defi Innovation and has attracted investors with its monetary performance. Talking about which, in a recent uniswap news, the team reported a strong $ 140 million in income and $ 95 million stated in asset value, in addition to a remarkable $ 12.4 million allocated for subsidies.

Successively the Uni price is constantly on the move and today it has taken the top of the top amplifier. Are you wondering if the uniswap price is ready for an outbreak? Read this short -term prediction in the short term for insights.

Onchain is getting stronger?

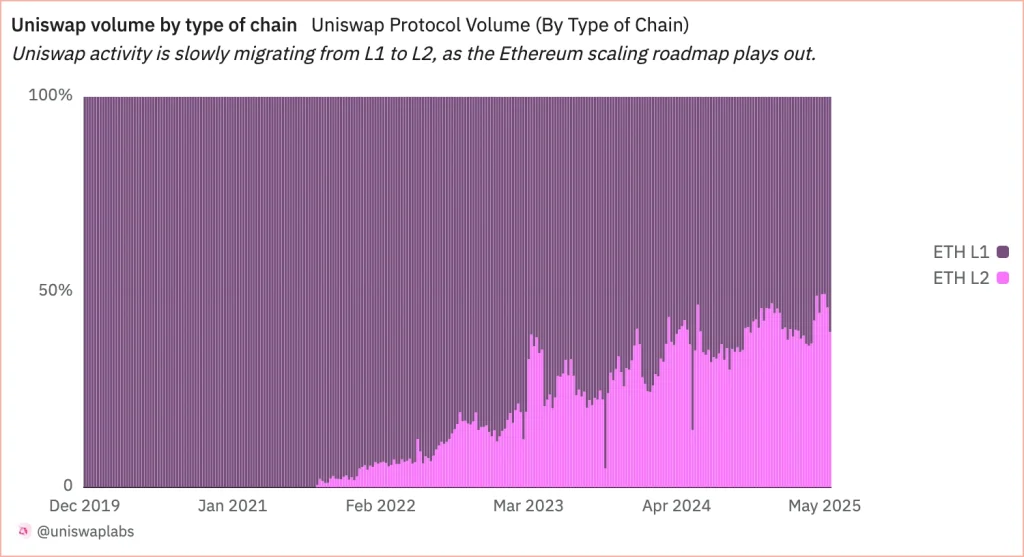

In addition to the Fundamentals level UPS, Uniswap X Buzz continues to create and push the protocol into the spotlight. One of the most convincing stories that shape the future of Uniswap is the migration of his activity of Ethereum Layer 1 to Layer 2, which reflects wider trends in the industry.

The uniswap -price diagram shows a bullish breakout from a consolidation kit, with the price that reflects from the $ 6.50 Entry zone and currently increased by ~ 15%. The graph shows a short -term resistance at $ 7.77, where some consolidation or a withdrawal could take place before a persistent rally. The 9-day SMA also acts as dynamic support, which suggests that the momentum remains strong in the short term.

Also read our uniswap price forecast 2025, 2026-2030 for long-term price objectives!

FAQs

The price increase of UNI is powered by strong Q1 -Financial data, bullish technical patterns and increasing trading volume.

While a relocation in the short term $ 7.77 Seems possible because of the momentum and card structure, which withdrawn to $ 6.5 is probably because traders take a profit in the vicinity of resistance.

At the time of publication, the price of 1 uni -token is $ 7.29, with a daily price butt of $ 10.19%.