- Altcoins have been hammered with almost $ 1 billion in long liquidations since the launch of Bitcoin ETF.

- Since BTC consolidates the demand in the vicinity of new highlights, Altcoins remain trapped in a speculative long squeeze.

Bitcoin Dominance [BTC.D] has done what it always does in a bull market, sucking liquidity and starving altcoins.

Even as Bitcoin [BTC] Printed a new of all time, megakaps such as Ethereum [ETH]Solana [SOL]and wrinkle [XRP] Couldn’t keep track of it. Forget new highlights, most large caps could not even turn important resistance levels.

But under the hood, the data tells an even sharper story.

Dissect the divergence

Before the 2022 bear market fell around $ 69,000 during the 2021 Bitcoin cycle in November, Altcoins followed almost the move.

A good example: Ethereum reached its all time at around $ 4,891, Solana peaked in the vicinity of $ 236, Binance Coin [BNB] Got up to $ 671, and even dogecoin [DOGE] made it to $ 0.73.

All in all, the liquidity flowed across the board and fed a broad rally. This synchronized revival? That is the “Altesean” fully in force. Fast-forward until now, and that synchronized rotation is missing.

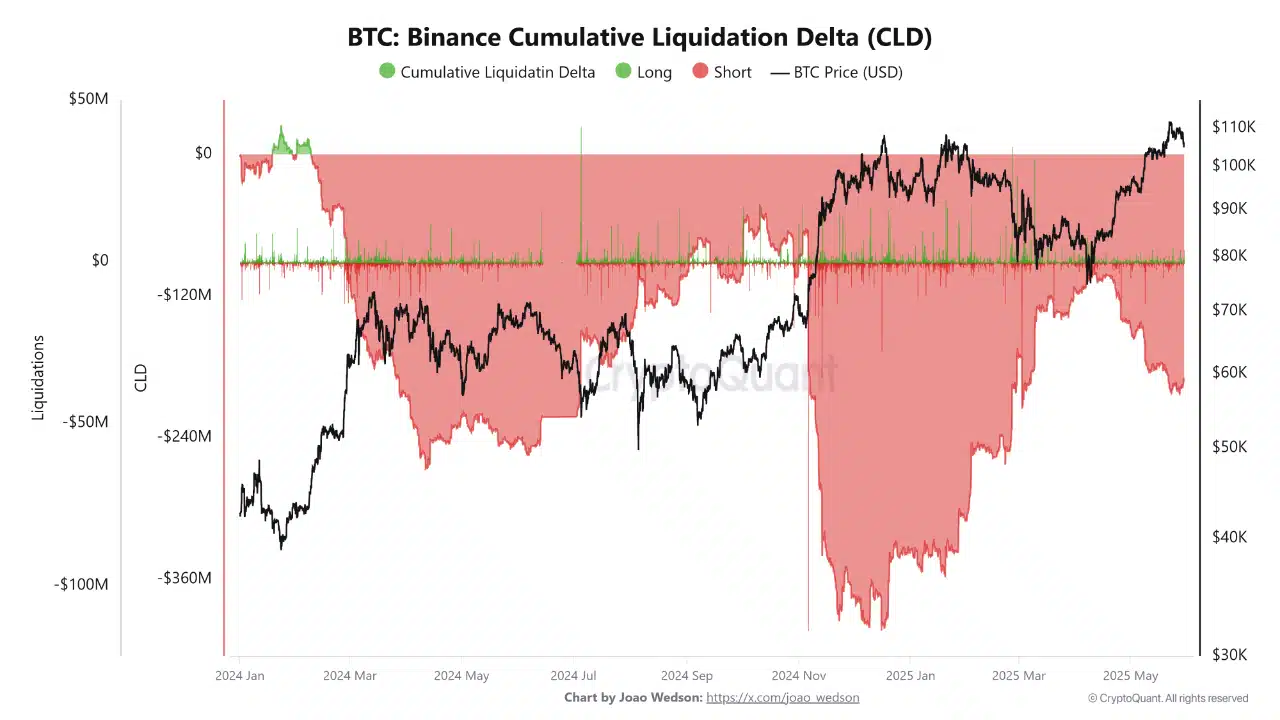

What has changed? Cryptoquant’s chain statistics Unveiling a clear divergence. Since the launch of the Bitcoin ETF, the liquidation behavior has been strongly divided between BTC and the rest of the market.

On Binance, Bitcoin’s cumulative liquidation -Delta (CLD) shorts that are crushed by around $ 190 million, which means that bears were pressed hard as BTC climbed higher.

Source: Cryptuquant

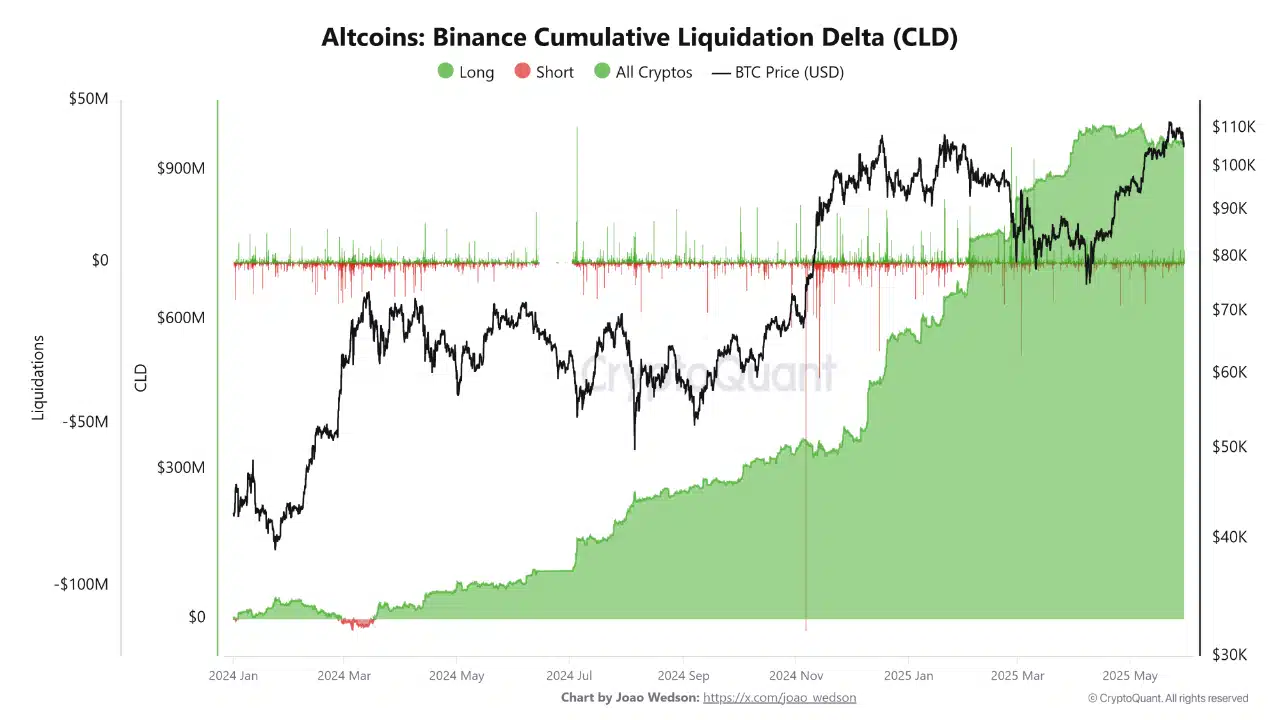

In the meantime, Altcoins played a completely different game. Long liquidations dominated the scene and surpass shorts with almost $ 1 billion.

This tells us that traders gamble big in an “altiation season” that never showed up and paid the price for it. Since December 2024, this gap has only become wider.

While BTC is holding a shorts with steam roller and breaks new soil, the loomtcoin bulls are wounded on the left, right and center while capital remains confident in Bitcoin.

Altcoins stuck in a long squeeze -loop

It is no surprise that the Big-admitted Alts Bitcoin did not follow new highlights. But even without touching that level, the damage was caused. Alts still took the hit. Some have even placed double digits.

Why? Because when BTC flirts with local tops or key resistance, capital usually starts to drip in alts who try to run the elusive ‘altical season’.

But this time that rotation carpet was plagued. No follow -up, no structural outbreak. Instead, only speculative inflow and overexposed lungs.

And it shows. Since April 2024, Altcoins’ Cumulative Liquidation Delta (CLD) Is consistently crooked in the direction of long liquidations.

Source: Glassnode

Simply put, since BTC is approaching new highlights, the structural question around it consolidates. Altcoins? Omitted in the cold. That makes any capital in high caps such as ETH, SOL or XRP more speculative.

What will come afterwards? Liquidation cascades. Failed pimples. Resistance levels that work as brick walls. In short, it is a classic liquidity loop.

So the next time Bitcoin pushes into price discovery, gambling on a full “altesh season” in 2021 style might jump on the gun.

Unless these Megakaps attract organic bidding support, a fresh highest uprising remains.