- Popcat achieved 9.08% in 24 hours in the daily charts.

- Bullish Momentum is built with a bullish crossover on RSI and Stoch.

After a local highlight of $ 0.41 to a low point of $ 0.29, Popcat [POPCAT] Successful $ 0.30 support defended and sent back.

As far as Popcat tries an outbreak from the falling channel after recording profits for two consecutive days, with a highlight of $ 0.339.

Popcat buyers are back

Popcat currently traded at $ 0.339, which marked an increase of 9.08% in the last 24 hours. In the same period, the trading volume of the Memecoin rose by 55% to $ 45.39 million.

An increase in the price increase, accompanied by volume, reflects the growing demand for an active, where buyers usually return to the market. As such, Popcat buyers have collected more than 8 million over the past 24 hours, according to the data from Coinalyze.

Source: Coinalyze

During the current Koopspree, sellers were sidelined while the memecoin places a positive delta of 700,000 tokens.

This increasing demand is especially clear in the derivatives market, where investors position themselves strategically for the next step.

In the Futuresmarkt, the open interest of POPCAT has risen by 6.69%, reached to $ 135.69 million – that traders actively enter both long and short positions.

Source: Coinalyze

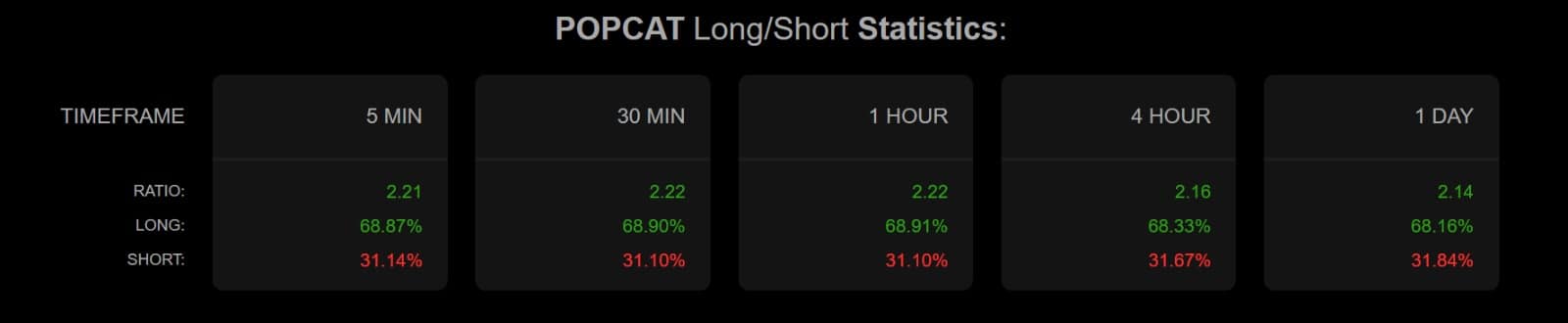

To assess the sentiment of investors, we investigate the financing speed of Popcat (FR) and a long/short ratio.

At the time of the press, Popcat’s FR remained positive about all the important trade fairs and held so in the past four days.

A consistent positive FR usually indicates a bullish sentiment on the futures market, in which traders expect further price gains. These prospects are supported by data with long/short ratio, which shows that long positions continue to dominate.

Source: Coinalyze

According to Coinalyze data, Longs accounts for 68.1% of Futures contracts, with shorts for 31% of the total. When Longs dominate, this means that most participants are bullish and expect prices to rise in the short term.

Can popcat achieve recent profits to break out?

The analysis of Ambcrypto shows that Bullish Momentum is gradually gaining strength for Popcat. Directions momentum indicators suggest that the upward trend of the Memecoin is building.

Popcat’s Stoch RSI in particular has made a bullish crossover for the past 24 hours. This cross -over indicates the reinforcement of the momentum, where to take a higher closing highlights.

Source: TradingView

The recent bullish crossover on the RSI of the coin reinforces the upward momentum of the token, which indicates a strong question from the buyer.

The current market conditions not only reflect bullish sentiment, but also the potential for continuous profits. If this momentum applies, Popcat could test resistance at $ 0.3712.

However, renewed sales pressure – especially after two days of profit – could, however, reverse this trend. A pullback can generate the price below the support level of $ 0.30.