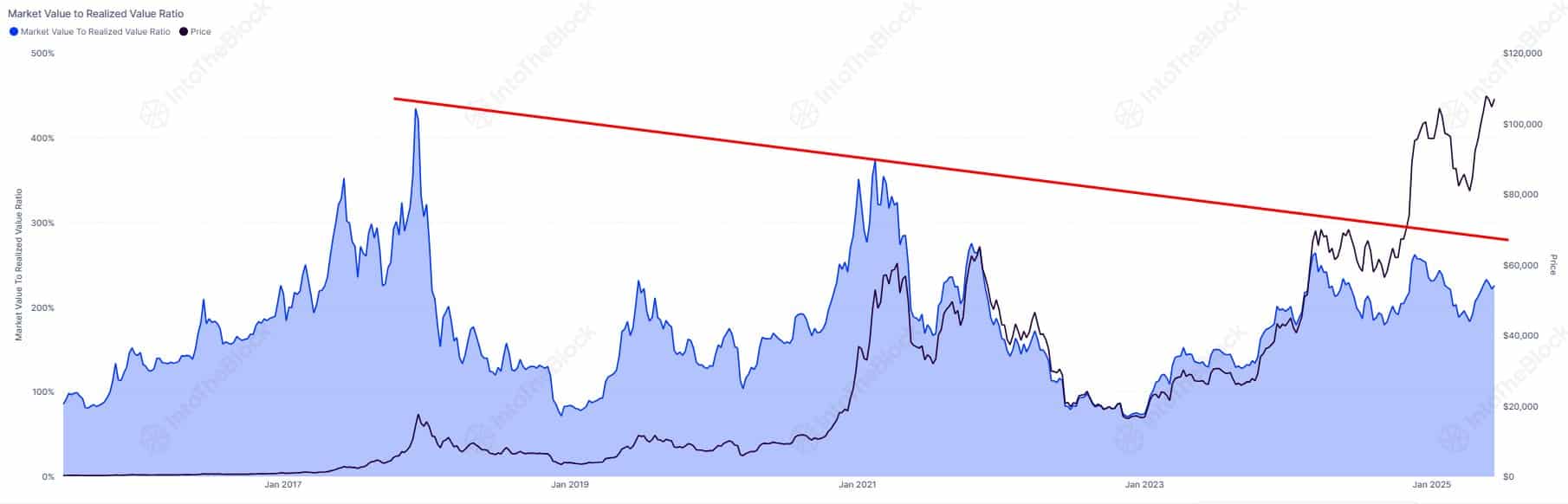

- MVRV at 2.25 suggested that Bitcoin remains far from peak conditions of the bull market.

- Exchange outflows rose while holders remain inactive in the short term, reducing immediate sales pressure.

Bitcoin’s [BTC] continued to float above $ 104k, but different signals on the chain suggest that the market has not reached euphoric extremes.

IN fact, a combination of undervaluation statistics, negative sentiment and silent activity in the short term indicates that the bull run can still be intact.

Mvrv says: this is not the top – yes

At the time of the press, the MVRV ratio remained at 2.25, well under Prior Bull Market Peaks despite the assets trading above $ 104k.

Historically higher MVRV values have tailored tops, but the constant long -term decrease in this metric means that Bitcoin still has room to walk.

That is why the current price promotion reflects sustainable momentum instead of extreme speculative behavior that is often seen in euphoric conditions.

Source: Intotheblock/X

Why is sentiment negative despite the Bitcoin rally above $ 100k?

Interestingly, Bitcoin’s weighted sentiment fell to -0.723, which unveiled widespread skepticism among traders and investors.

Usually a negative sentiment suggests disbelief in the durability of the rally during an upward trend.

However, contechanical analysis often regards this as a bullish signal, which implies that the market still keeps potential upward. While the doubts about the public, fewer participants will probably take prematurely profit.

Consequently, sentiment-driven resistance remains weak and supports the possibility of continuous price expansion in the short term.

Source: Santiment

Can BTC NVT and Puell Multipel indicate undervaluation?

Both N / A Golden Cross And Puell -more than 23% and 25% fell respectively.

Together they suggest that the price of Bitcoin still catches up with Fundamentals on the chain. Miners show no stress and network activity is not in overdrive.

In other words – no foam. This points to value -driven growth instead of a speculative increase.

Source: Cryptuquant

Do BTC investors differ from long-term company?

On the chains exchange statistics Shows an increase of 10.72% in mumbling and a decrease in the influx of 10.27%.

This behavior indicates that more Bitcoin is withdrawn from fairs than deposited. Such a pattern usually reflects the intention of investors to sell instead of selling, which reduces the sales pressure in the short term.

Moreover, strong flow often precedes the supply, the upward momentum reinforces when demand increases. That is why this strengthens the story of trust among holders during the rally.

Source: Cryptuquant

Why are holders unusually quiet in the short term during this increase?

Data Realized CAP HODL waving data show short-term activity (0D-1D) at just 0.278, a considerably low level during a Bullish Run.

Usually peaks when new investors take a profit during fast price increases. However, the modest behavior here indicates that holders of short term do not actively cash in.

As a result, the lack of fresh sale reduces overhead pressure and reinforces the case for persistent upward impulse, with seasoned holders being in control.

Source: Santiment

Will long liquidations cause the following major correction?

According to the Binance liquidation map, a large cluster of long liquidations is just below the $ 104k level.

If the prices fall under this threshold, this could activate to activate forced sale, which intensifies downward volatility.

However, significant short positions are just above, which suggests that it is potential for a short squeeze if the price breaks higher instead.

That is why the market remains at a critical intersection where liver dynamics could dictate the next decisive movement.

Source: Coinglass

The Rally of Bitcoin above $ 100k has no traditional signs of overheating the market, because indicators at the chain remain neutral or even bullish.

Negative sentiment, falling valuation statistics and keeping behavior suggest that the upward trend can still have fuel.

However, increased long -term liquidation levels emphasize risks in the short term if support breaks.

In general, the data sketches a picture of careful optimism, where the fundamental strength remains intact, but can shape leverage and sentiment in the short term volatility.