The largest stock exchange in Russia is the addition of futures trade for Asset Management Titan BlackRock’s Ishares Bitcoin Trust ETF (IBIT), one of the largest listed funds in the world, to the production of products.

In a new announcement, Moscow Exchange (Moex) – the government of Russia in the world of Crypto activa – says that it adds support for the product from 4 June, although only to accredited investors.

“Keep in mind that today, 4 June 2025, the IBIT-9.25 (IBU5) Futures contract, only permitted to qualified investors, starts … qualification controls on the exchange side will be implemented from 23 June 2025.”

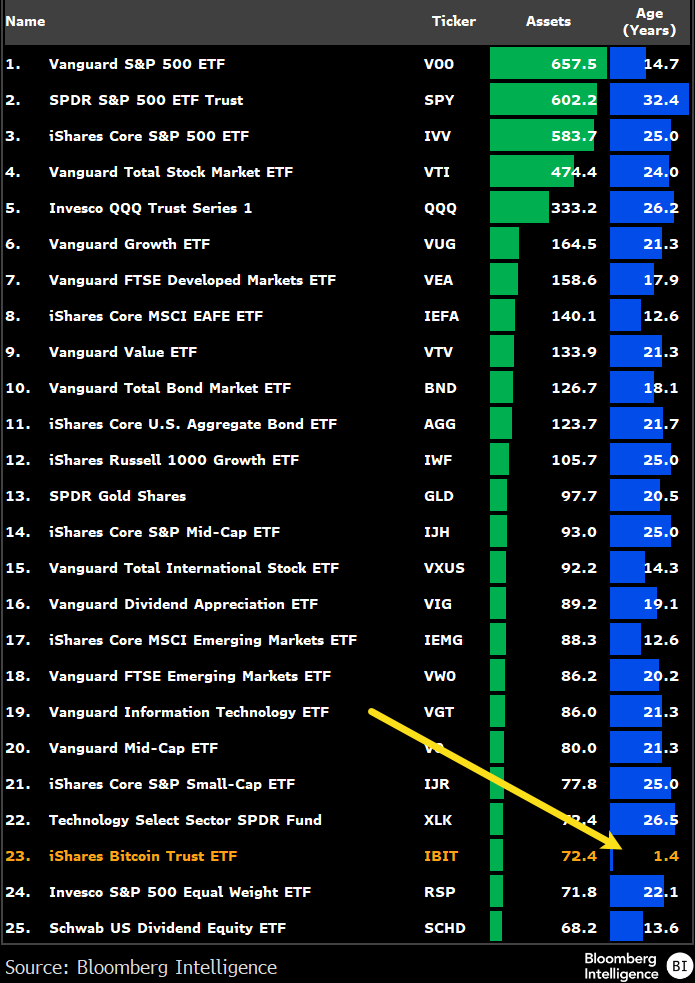

Ibit, which was launched in January 2024, after years of his approval stopped by the US Securities and Exchange Commission (SEC), was recently in the list of Top 25 ETFs in the world and came to just over $ 72.4 billion in assets under its management.

According to Bloomberg ETF specialist Eric Balchunas, the launch is considerable because IBIT is still relatively young compared to most ETFs on the list.

“Here is a table of the top 25 largest ETFs and their age. At 1.4 -year -old IBIT is [the] Youngest on the list of nine times. It is like a baby who hangs around with teenagers and people in their twenties. Rather [possibly] The most insane Ibit state so far. “

IBIT acts for $ 59.92 at the time of writing, a marginal purchase during the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t miss a beat – Subscribe to get e -mail notifications directly to your inbox

Check price promotion

Surf the Daily Hodl -Mix

Generated image: midjourney