- Ethereum received a boost after Sharplink bought $ 463 million from ETH

- Whale activity and a peak in new deposits seemed to support Ethereum’s price spring force

The prize of Ethereum is steadily consolidating around $ 2500 range last month. This has been the case, despite the mixed signals from the wider market.

Although it is not yet in bull mode, ETH has been strong all the time because it is fighting extreme drawing. This consistency is more interested in both retail and institutional investors.

Source: TradingView

Sharplink’s enormous Ethereum investment suggests strategic recalculation

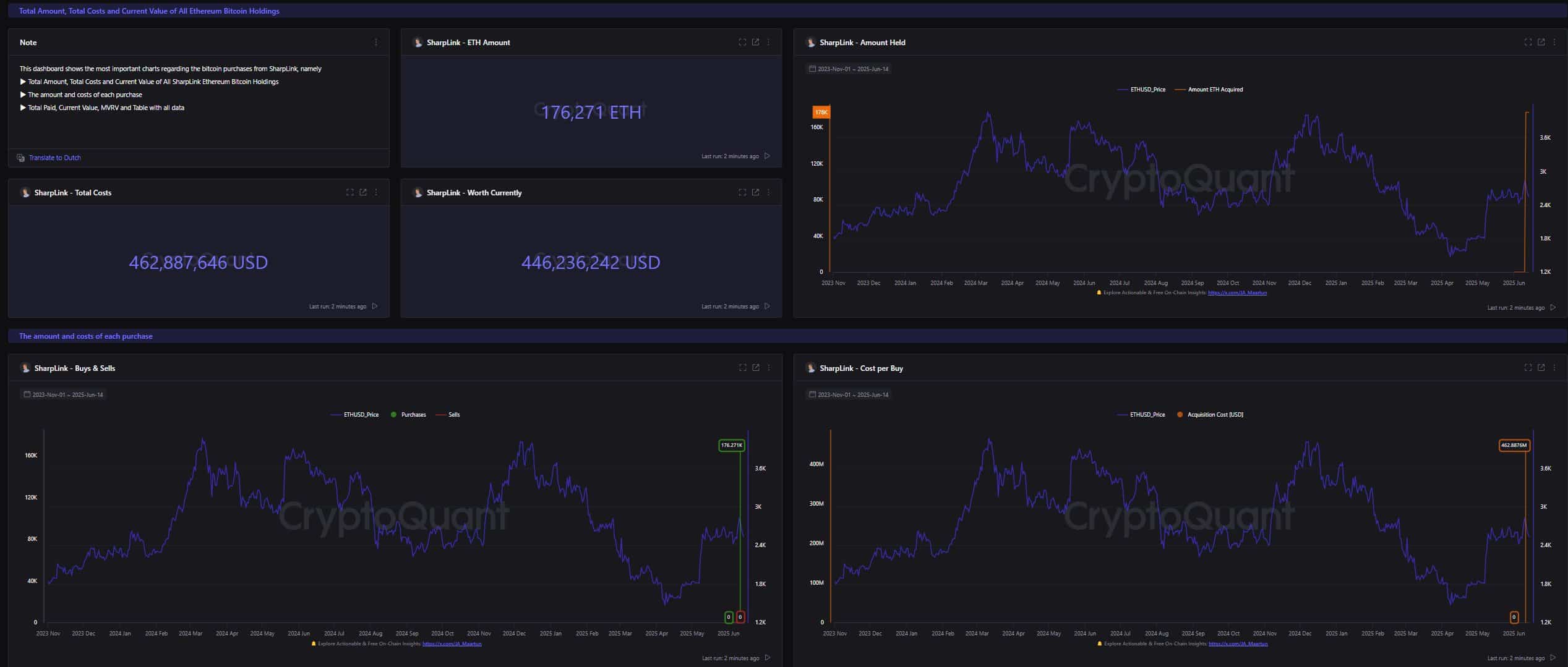

In a movement that is as fat as that of micro strategy, Sharplink recently bought 176,271 ETH – worth it $ 463 million. The company is now the largest listed holder of Ethereum. The move can make again how public companies see and include ETH in long -term investment positions.

The aggressive buy-in from Sharplink indicates strong confidence in the future use of Ethereum in cross-border financing. Just like Micro Strategy’s bet on Bitcoin during the first institutional wave, this Eth-Buy-in can release the road for others.

Source: Cryptuquant

Settings’ favorite asset?

The timing of Sharplink’s Buy corresponds to a wider trend. Most traditional companies now heat to crypto assets. Ethereum, with its ecosystem of smart contracts, Defi protocols and stake opportunities, is increasingly being seen as more than just a speculative game.

This narrative shift-of a high risk asset to institutional portfolio component in the long-term win over all Poles. As the regulations become clearer, more companies can consider Ethereum. Not only as a hedge, but as a core competition.

Whale activity and span of the keeper add fuel

Data on the chain has also shown that smaller whale entities that have accumulated between 1,000 and 10,000 ETHs have accumulated on price levels of the press. Their actions hinted with confidence in a price base and a potential benefit.

Source: Cryptuquant

Moreover, the number of unique deposits who have interaction with Ethereum has also risen considerably.

Such an increase in network activity adds more fuel to the bullish momentum of the Altcoin. It also reflects the growing retail involvement and long -term belief in the usefulness of ETH.

Source: Cryptuquant

From rising institutional interests to increasing whale confidence, the foundations of Ethereum have been strengthened lately. The investment of $ 463 million from Sharplink could even be the first of many headline movements in the next adoption cycle of ETH.

If ETH follows the process that Bitcoin did after the buy-ins from MicroSstratey, we may be at the start of a new Ethereum story.