Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

While Bitcoin (BTC) came almost under the psychologically important $ 100,000 marking last week, the short-term holders (STH) Cohort began to show signs of weakening conviction in the leading cryptocurrency, increasing the fear of a deeper price correction.

Bitcoin StH fear indicates

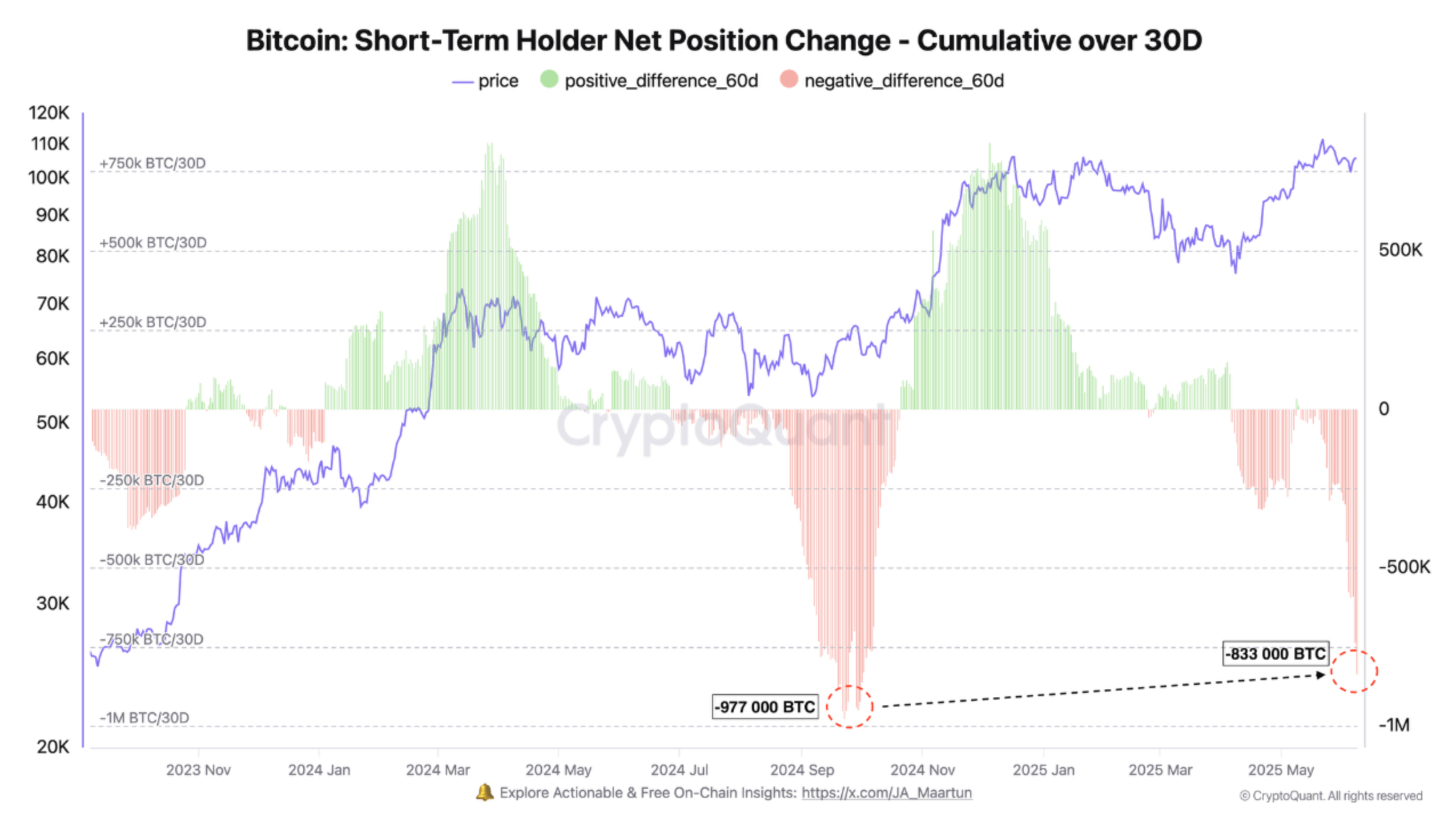

According to a recent cryptoquant Quicktake post from employee Darkfost, the net position of Bitcoin STH has become strongly negative in the past month. This happened despite the fact that BTC is retained above the $ 100,000 level.

For the non -ethics, Bitcoin StH are investors who hold their BTC less than 155 days. They are generally more reactive to price volatility and market sentiment, often selling during corrections or uncertainty.

In particular, a cumulative net position change of -833,000 BTC is registered among short -term holders during the ongoing withdrawal. For comparison: the April crash saw a net position change of approximately -977,000 BTC.

Related lecture

Darkfost noted that the current STH behavior is strongly resembled the activity that was observed during the short decrease in BTC under $ 80,000 in April 2025, when the digital asset to $ 74.508 Batte. The analyst wrote:

Since then, STH seems to have become much more sensitive to market movements, and the recent dip around $ 100,000 was enough to activate renewed fear in this group of investors.

BTC shows signs of reversal

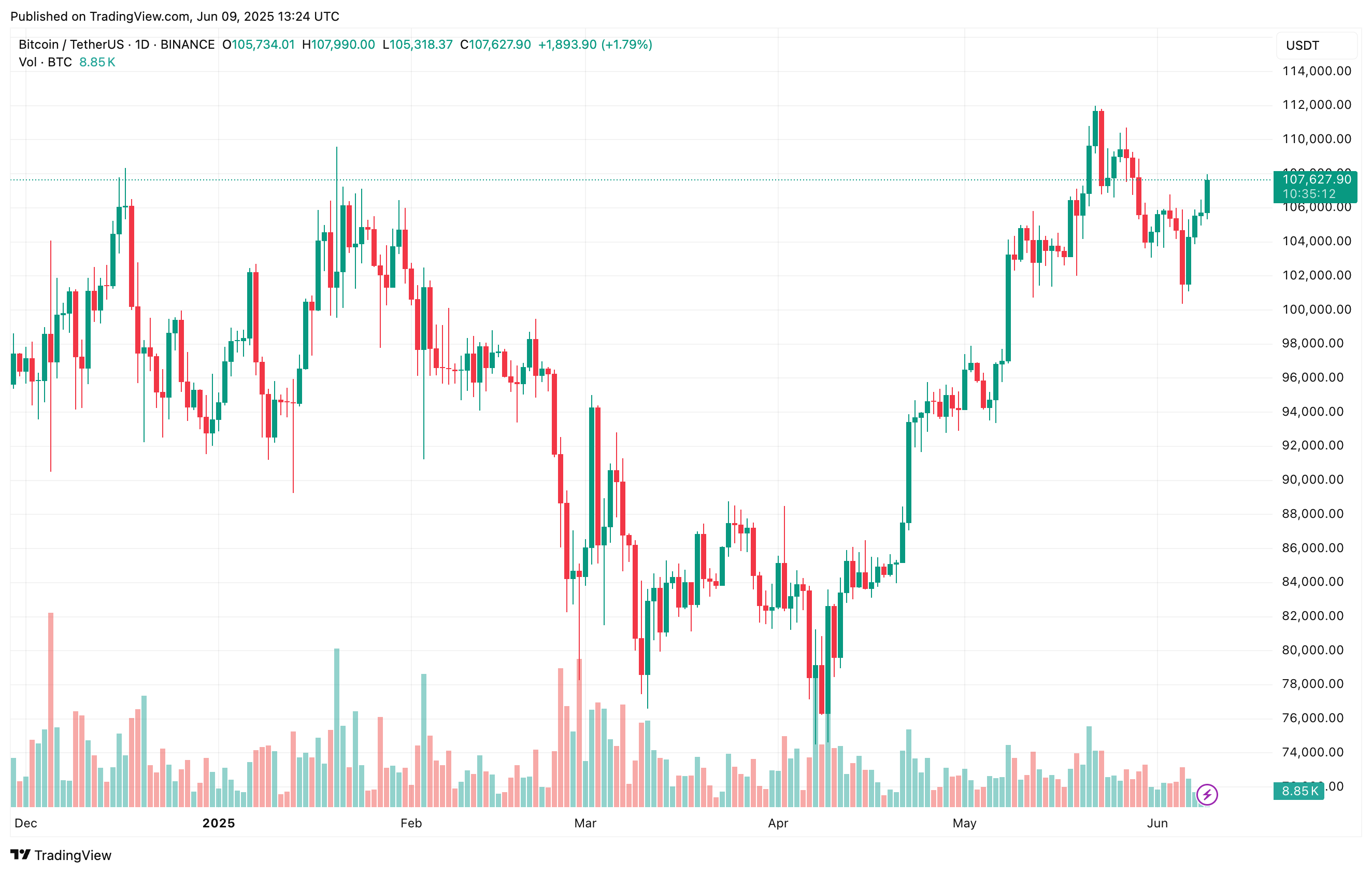

Although BTC Momentum lost after reaching its latest all-time High (ATH) of $ 111,814, the leading cryptocurrency recovered the power in the weekend-what indicates that a possible reversal can be underway.

Related lecture

For example, seasoned crypto analyst Ali Martinez noted that BTC broke the most important resistance level at $ 106,600. In a recent X post, Martinez predicted that Bitcoin could collect up to $ 108,300 or even $ 110,000 if the current momentum continues.

In a separate X-post, Collega-Crypto analyst stretches Capital the next Bitcoin Daily Chart, and noted that the cryptocurrency not only from its two weeks of falling trend-marked trend-marked in light blue-but can now change that former resistance to a new level of support.

In the meantime, various technical indicators also indicate a secondary bullish momentum. Bitcoin’s hash ribbons in particular recently flashy An excellent purchase signal.

In addition, data on chains suggest That BTC could experience a sharp upward movement in the short term, possibly driven by a negative financing speed on Binance. A long -term period of negative financing percentages is often the stage for a short squeeze.

Despite the bullish prospects, some red flags remain. Recent recent information to show That holders gradually leave the market in the long term, while an influx of retail investors can add volatility to the current rally. At the time of the press, BTC acts at $ 107,627, an increase of 1.9% in the last 24 hours.

Featured image of Unsplash, Cryptoquant graphs, X and TradingView.com