Solana has signed a MOU with Kazakhstan to set up the first sol-based economic zone of Central Asia. This strategic move helps to make it in a region that is responsible for almost 20% of the worldwide crypto trading volume. This strategic movement positions Solana as a crucial infrastructure layer in one of the fastest growing markets of Crypto.

The news has aroused the interest with investors, who now keep an eye on the price movements of Solana for short -term insights. While the MOU offers a long -term wind in the back, the immediate question about the spirit of the traders is: can Sol Momentum build to bounce back from the current lows? In this SOL price analysis I take you through the network health of Solana and how it could perform in the charts.

On-chain statistics Fuel Solana?

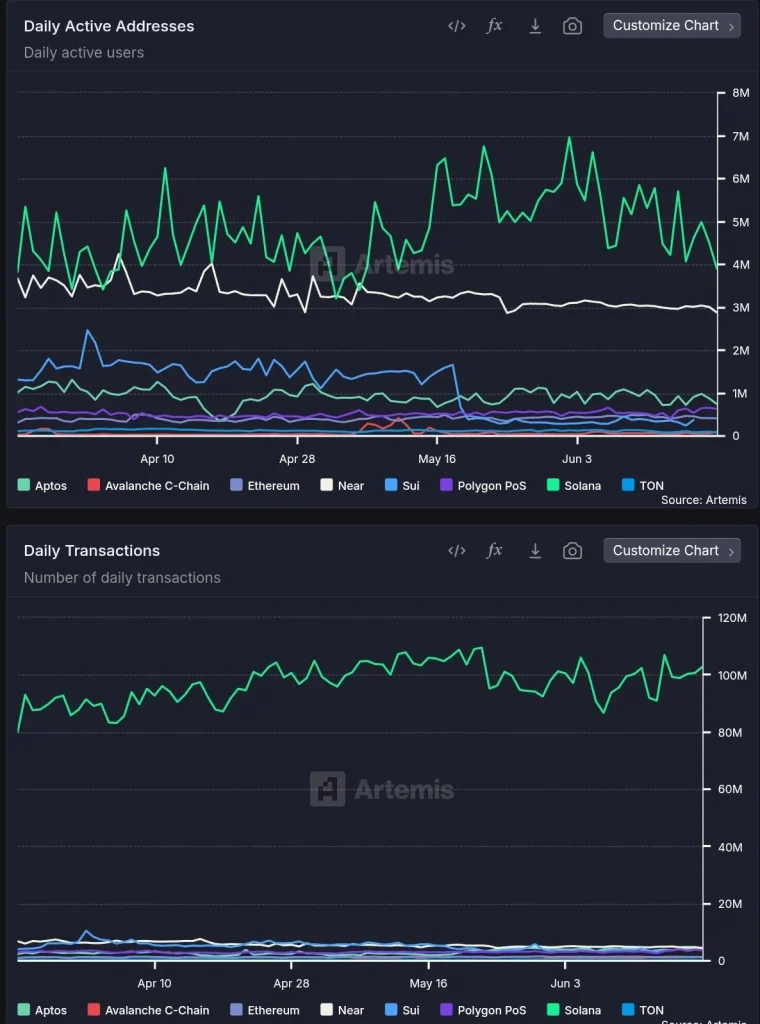

According to data from ArtemisSolana maintains a leading position in both daily active addresses and transaction volume. Solana network is on average more than 1 million daily active users, who considerably surpasses Ethereum, Avalanche and Polygon.

Successively, an outbreak can push prices to $ 148, $ 152 and $ 156.88 respectively. On the other hand, $ 129 remains the critical support to view. With Fundamentals reinforced by the activity of Kazakhstan Mou and On-Chain Sterk, SOL seems ready for a short-term rally, provided that the momentum applies.

Also read our Solana (SOL) Price forecast 2025, 2026-2030!

FAQs

This MOU gives access to ~ 20% of the global crypto volume. The hosting of the first sol economic zone could scale the regional adoption of Solana.

If the Bullish Momentum continues, SOL could test $ 148, then $ 152 and $ 156. The most important support for $ 129.

The price of 1 Sol at the time of press is $ 134.14, with an intraday change of -0.34%