Solana (SOL)

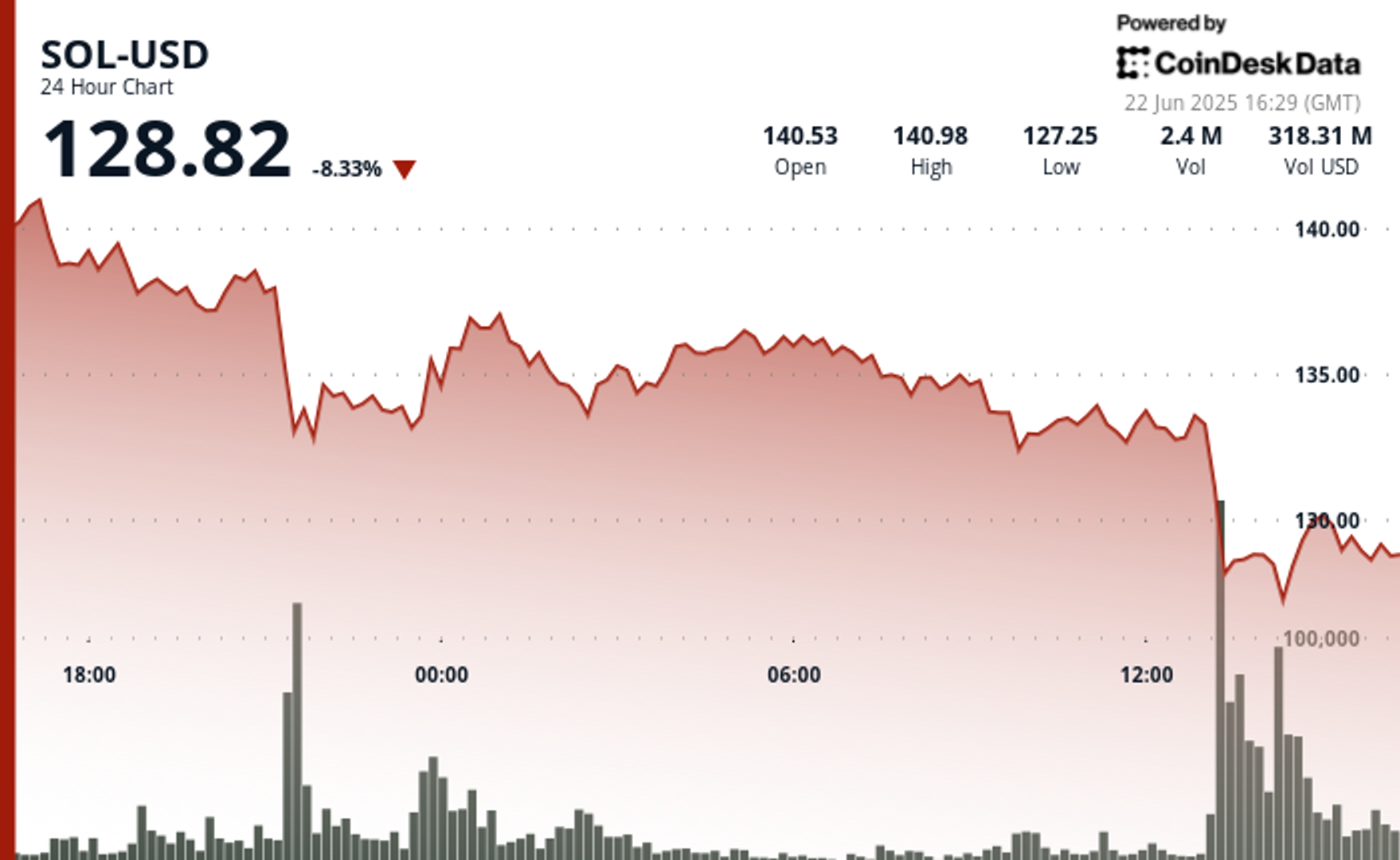

is traded at $ 128.82, a decrease of 8.33% in the last 24 hours, after a steep intraday correction linked to rising geopolitical tensions. The Token fell from $ 140.39 to $ 127.25, with the sharpest decrease of the hour that occurs at 13:00, when the sales pressure and the trade volume exceed 4 million, according to the technical analysis model of Coindesk Research.

The market reaction followed confirmed reports of American military strikes that focus on Iranian nuclear sites, causing widespread risk aversion on crypto markets.

Some traders are now worried that a closure of the Strait of Hormuz, even if they are temporary, could increase oil prices. That would probably generate inflation, reduce the chance of accelerating food rates in the short term and extending the risk-off environment to harm crypto markets. A direct attack on the Waterweg could intensify the sale in Altcoins, because Bitcoin dominance rises historically during periods of geopolitical unrest.

The decline of SOL also marked a break among the most important technical levels, including the 200-day simple advancing average near $ 149.54. During the session, Sol printed lower highlights and struggled to maintain rebounds, which indicates the weakening of the market structure. With increased volume on red candles and technical indicators that Beararish flashes, traders now see the $ 120 – $ 125 zone as a potential support area.

Technical analysis highlights

- Sol fell by 8.1% from $ 140.39 to $ 129.02 during the analysis period, which was a decrease of $ 11.37.

- The widest price range of the session extended from $ 141.14 to $ 126.85, an intraday swing of 10.2%.

- The biggest fall of the hour took place at 13:00, with the price falling from $ 133.58 to $ 128.82 at a volume of 4.03 million.

- A decreasing channel developed during the session, with lower highlights and lower lows that confirm the structure of the Bearish.

- Key resistance formed at $ 133.80, which made multiple rebound attempts.

- The first support came to the fore at $ 127.43, while a new intraday floor was formed at $ 128.90.

- From 15:25 to 15:27 a volume peak pushed the price below $ 129.30 during a continuation.

- Late session movement showed Sol-trade between $ 130.42 and $ 128.85 under consistent sales pressure.

- Different recovery attempts near $ 130.05 failed as the volume increased with every rejection.

- Significant nutritional concentration appeared near $ 130.20, which strengthened the bearish Momentum in the short term.

Safeguard: Parts of this article have been generated with the help of AI tools and assessed by our editorial team to guarantee the accuracy and compliance with Our standards. For more information, see The full AI policy of Coindesk.