- Cost -based, trendline and profit statistics showed that TRX remains in a bullish setup.

- Whale activity, address growth and reset sentiment reinforce the interim accumulation cancellation.

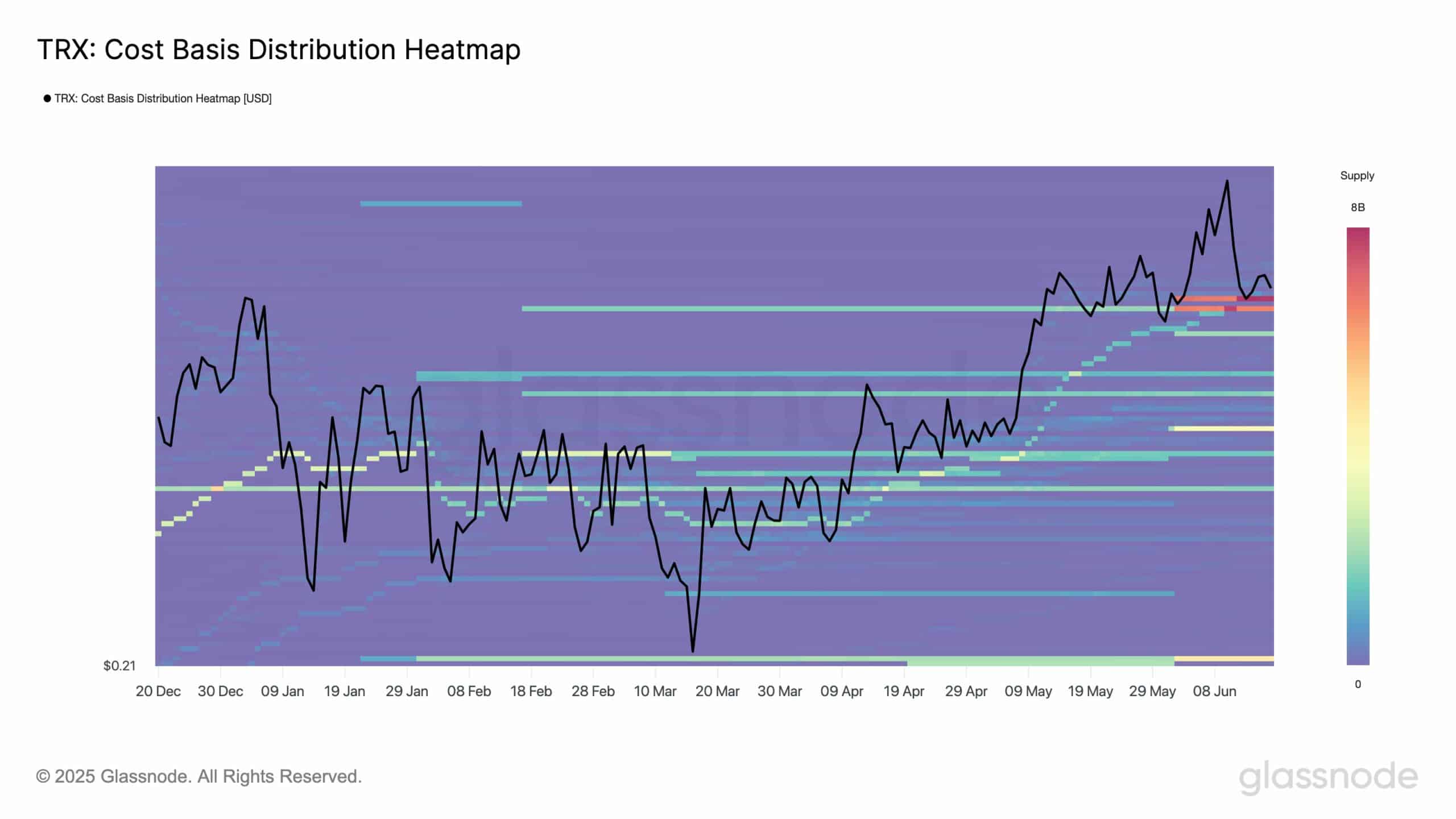

Tron [TRX] continues to consolidate in the vicinity of an important accumulation, with more than 14 billion TRX between $ 0.26 and $ 0.27, according to Glass node on X (formerly Twitter).

This zone represents the strongest support cluster on the cost basis with a heat base, which reflects a concentration of long -term positioning.

In the meantime, the price of the TRX of $ 0.274 floated just above this anchor, at the time of the press, with thin resistance.

While the market in the vicinity of this threshold navigates, increasing the exposure to whales, a steady address activity and a restorative sentiment can form the short -term tril of TRX.

Source: Glassnode

Can TRX maintain his bullish process above the trendline?

TRX has remain trend above his rising trendline that has held since March, while maintaining its overall bullish structure.

Despite recent pricebackbacks, the trendline and fibonacci levels remain between $ 0.27 and $ 0.28 intact.

Moreover, the MACD line began to cross its signal and point to a possible bullish momentum recovery.

This trend line has acted as dynamic support and it would be essential for a movement to the $ 0.30 resistance zone in the upcoming sessions.

Source: TradingView

Most holders remain profitable, which reduces sales pressure risk

At the time of the press, IntotheLock data showed that 75.11% of all TRX addresses were “in the money”, a total of 70.47 billion TRX.

In addition, 13.66% of the portfolios were ‘with the money’, directly within the range of $ 0.267 – $ 0.275.

Only 11.23% stood for non -realized losses. This distribution indicates that most holders are not under pressure to leave their positions.

With this structure, the sales pressure can remain minimal, especially because TRX stays within or above the cost -base cluster.

Source: Intotheblock

Whales and investors increase their TRX positions aggressively

The latest historical concentration data revealed an increase of 9.59% in whale ownership during daily days. Even more important is the increase of 38.21% with long -term investor addresses.

Retail portfolios grew modestly with 4.10%and showed less aggressive activity compared to institutional participants. This positioning emphasizes silent accumulation by large entities.

If this trend persists, this can lay the foundation for stronger price action as soon as the technical and macro conditions are more favorable.

Source: Intotheblock

New address growth points for expansion of the Tron network utility

In the past week, Tron has seen an increase of 32.15% in a new wallet creation, in combination with a 6.68% increase in active addresses.

At the same time, zero-balance addresses fell by 10.52%, which implies better retention and actual use. This trend consistently reflects onboarding of new users and signals that improve the Fundamentals.

Continuous expansion of the address base, especially in addition to bullish investor behavior, often precedes the strong price rating in the medium term.

Source: Intotheblock

Was the recent sentiment a bullish fall or a signal?

The weighted sentiment data from Santiment show a competitive wave above 7.5 followed by a rapid reversal to −0.3.

This indicates that euphoric expectations emerged quickly before they corrected, a pattern that is often seen before consolidations.

Although sentiment enriches due to speculative excitement, the shelter may be reset the market for a healthier move.

When optimism returns and matches technical support, TRX can regain the momentum with a reduced risk of overheated positioning.

Source: Santiment

Tron continues to build power just above an important support cluster, with more than 75% of holders in profit and rising whale exposure. New address creation and falling sales pressure offer further reinforcement.

If the rising trendline applies and the sentiment gradually recovers, TRX could collect to $ 0.29 – $ 0.30 in the coming days.