- Bank of America accelerates a USD Stablecoin.

- Tron processes $ 691b in USDT transfers, led by whales.

Bank of America is reportedly following his own American dollar-supported Stablecoin quickly-a sign that Legacy Finance is no longer satisfied to sit on the sidelines.

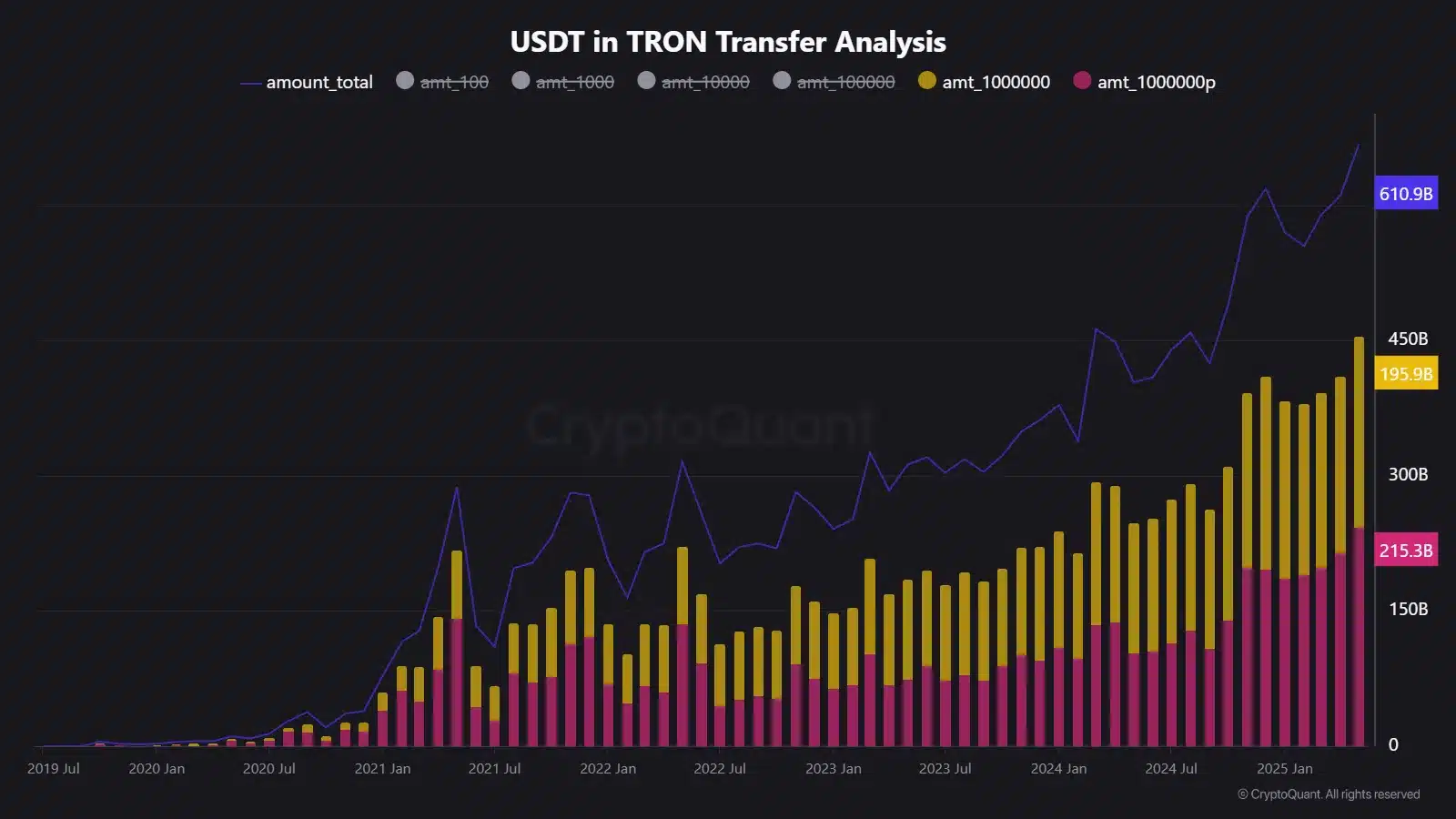

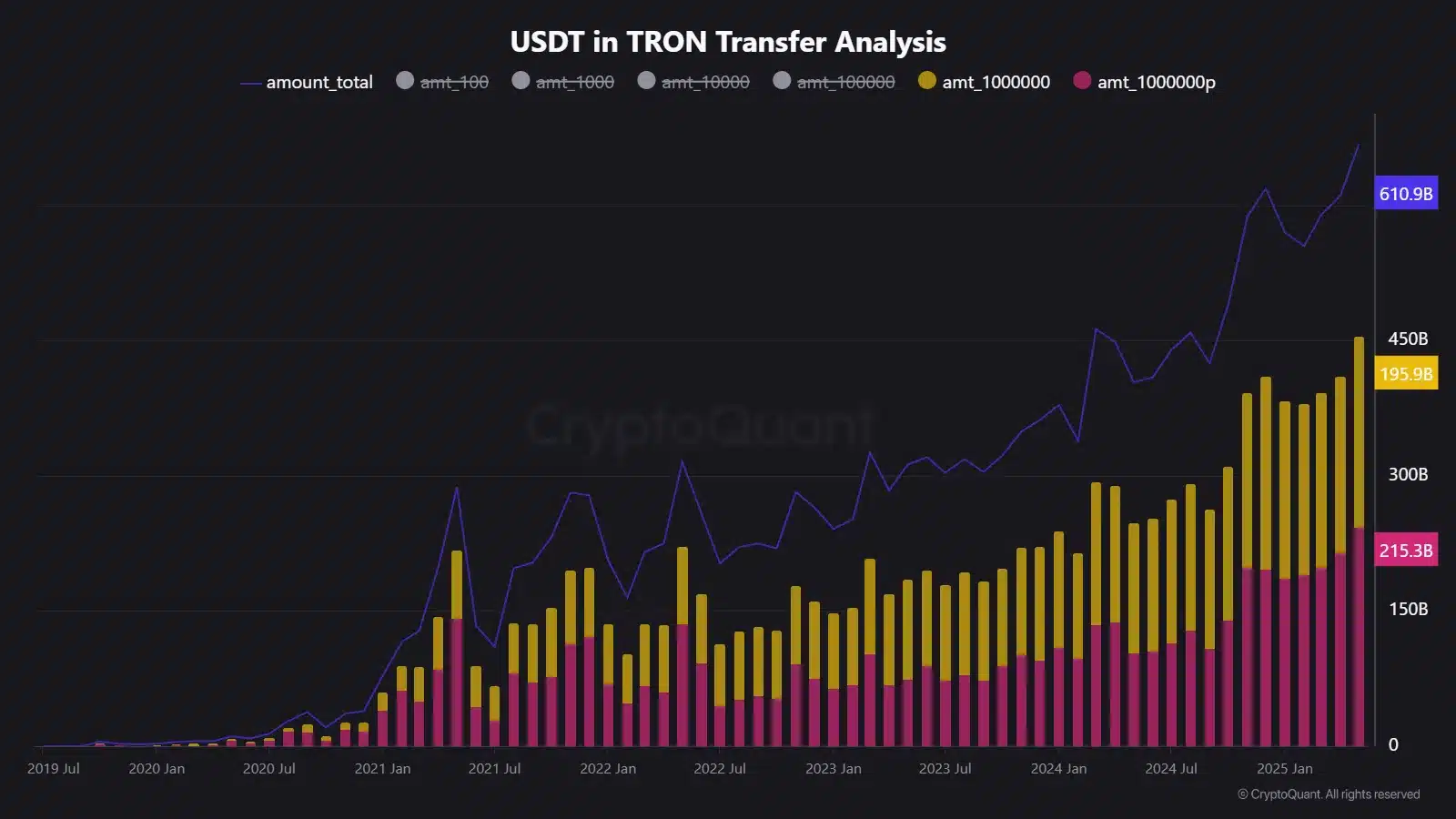

At the same time, tron [TRX] Has quietly shattered records and processes more than $ 691 billion in USDT transfers in a few months, with whales responsible for a stunning $ 411 billion of that electricity.

While traditional banks are preparing to challenge blockchain-native networks, a new era of competition takes shape.

Tradfi Waadt deeper in Blockchain -Wateren

Bank of America’s Stablecoin ambitions are an important shift in how large banks are approaching digital assets.

Once carefully, the bank giant now leans in blockchain as a core pillar of his future strategy; Driven by the promise of faster settlements and competitive pressure of peers.

While earlier conversations about cooperation with JPMorgan Chase and others still have to materialize, Bank of America is moving forward.

Speaking at a recent Morgan Stanley conference in New York, Brian Moynihan, CEO of Bank of America, sheds light on the shifting attitude of the bank:

“We involve both in industry and independent. The technology has been understood for a while-what we stopped was the regulatory fog. It was not clear that we were even allowed to continue under existing bank rules.”

Tron: A whale highway for Stablecoins

While Wall Street is preparing his stablecoin debut, Tron is already deeply in the processing of a record of $ 694.54 billion in USDT transfers only this May.

According to Cryptuquant, Almost 60% of that volume came from whale chanties of more than $ 1 million, a total of $ 411.2 billion. Tron now leads all block chains in Stablecoin Dominance, with more than $ 75 billion in TRC-20 USDT.

Source: Cryptuquant

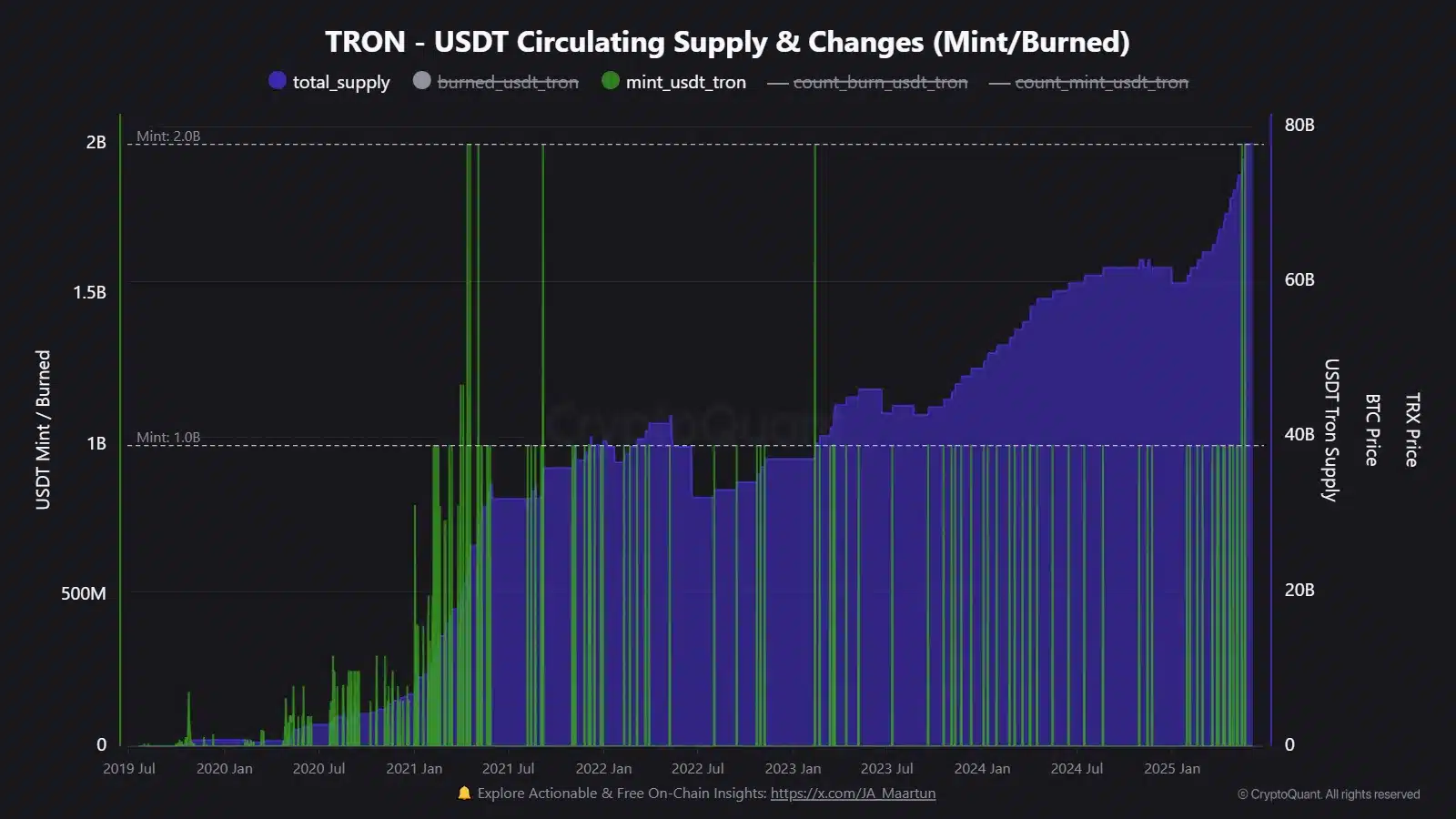

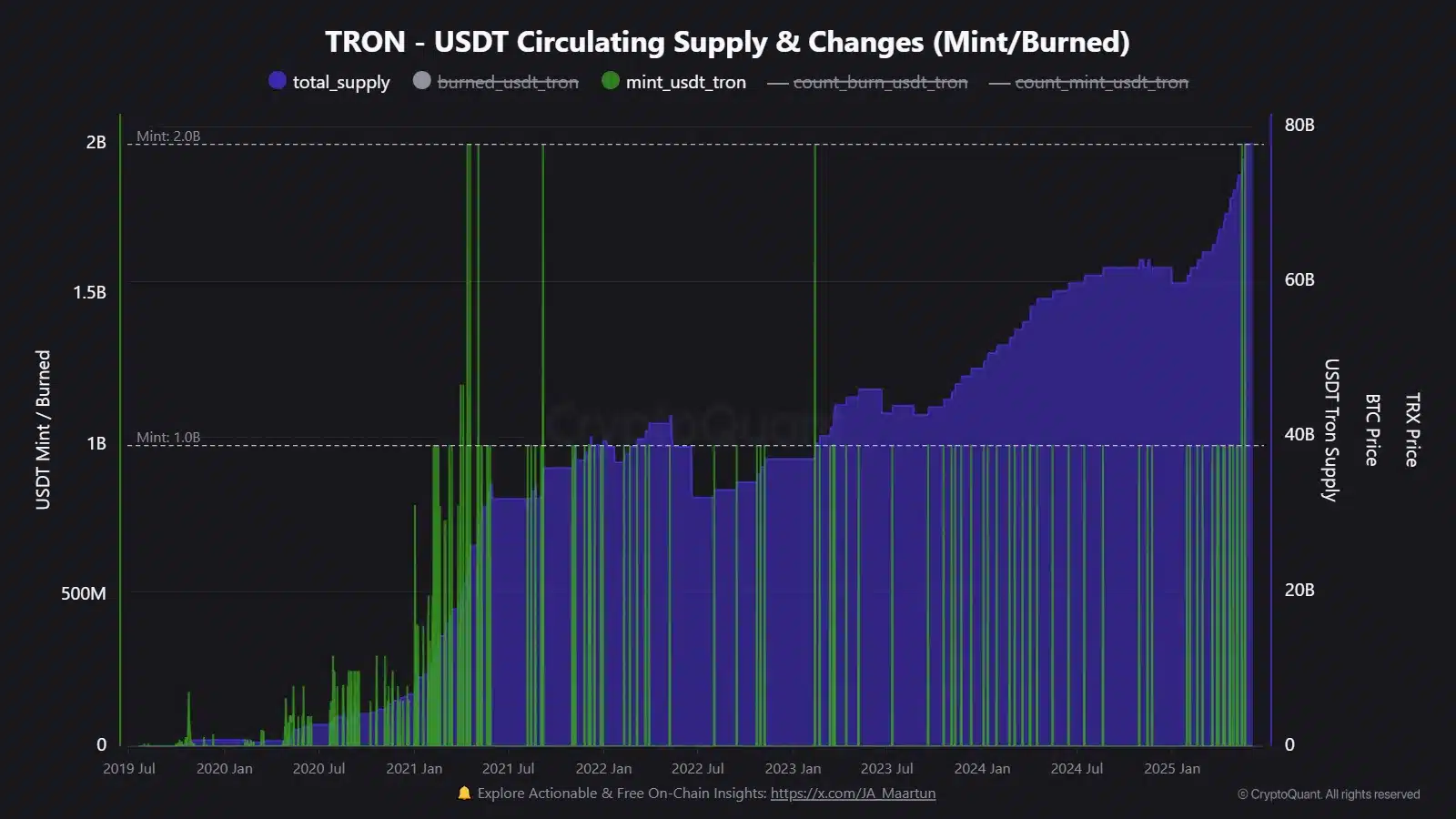

With 17 separate $ 1 billion-plus peppermints already in 2025, the pace of the network does not show any signs of delay.

The cumulative transactions of 10.5 billion clearly emphasize one thing: when it comes to quickly moving big money, choose Crypto -Walvissen Tron.

Source: Cryptuquant

Wider bet

The Stablecoin race now influences global financial and monetary policy.

In emerging markets, Dollar-Pegged Stablecoins such as USDT Grip on Easters and Inflation Covers win, so that the US dollar effectively exports.

In the meantime, the FED is under increasing pressure to clarify its supervisory role.

During congress sessions at the beginning of June, the legislators revived the debate about the potential risks of Stablecoins for financial stability, referring to their growing influence on the Treasury markets.

At the same time, global central banks accelerate CBDC pilots … making it clear that the future of digital money is no longer theoretical.

Next: Fartcoin’s $ 2.48 million whale input may not be enough, unless this happens next