- Uni bounced from $ 5.80 to $ 6.30 after a large whale bought more than 400k tokens on Binance.

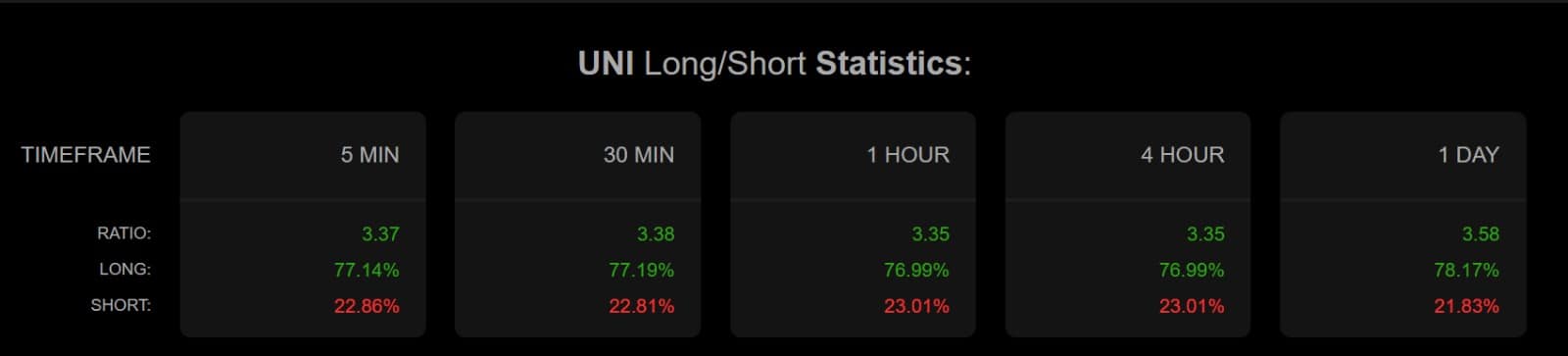

- More than 78% of the Uniswap -Future contracts are long, which reflects a strong bullish bias among traders.

Three days ago, Uniswap [UNI] Tried an outbreak of a parallel channel and stimulated a local highlight of $ 7.6. However, the Altcoin was confronted with a strong rejection.

The pullback dragged the prices to $ 5.80, but instead of activating panic, it has set up a new buying option.

Whales are starting to gather

As such, whales return to the market. A remarkable example – heyed by Lookonchain– Steal a whale buses and 401,573 uni collection worth $ 2.46 million from Binance.

Such a massive purchase gives confidence in the market, because this whale regards the current value as cheap enough to take a strategic position.

Source: Coinalyze

It was not just this single buyer

Looking at the spot volumes of Uniswap, buyers bought 3.18 million uni -tokens, with a positive imbalance of 907,000 uni recording.

It suggests that buyers dominate the market. This reflects a strong demand for the Altcoin.

Source: Coinalyze

The demand for the Altcoin is especially high in the futures market.

Looking at the financing figure on Uni, this metric has kept positive for the past three days. This means that investors on the Futuresmarkt bet on prices to rise, so they usually take long positions.

Data corresponds to this, because it showed that 78% of all Uni -Futures positions are long, while Shorts are only 21.83% good.

Such a huge gap means that investors who expect prices will rise are the majority in the market. This reflects a strong bullish sentiment among investors who can lead to higher prices if the market does not experience long squeeze.

Source: Coinalyze

A high demand usually leads to an upward pressure on prices. So, if the question observed applies here, we would see Uniswap making a strong rebound on his price charts.

What is the next step for Uni?

According to the Anniswap’s analysis of Amuscypto, Uniswap had experienced a strong question.

As such, buyers return to the market.

The level of $ 6.00 has kept strong support. After tagging $ 5.80, Uni bounced up to $ 6.30, driven by the rising demand from both whales and retail traders.

If this strength applies, a retest of $ 7.08 and then $ 7.60 can follow.

However, if the question decreases and buyers withdraw, uni can slip back to $ 5.70. The next few sessions are likely to decide whether this is a real trend removal or just a relief bouncing.