The Uniswap Basis has launched its Q1 2025 Monetary Report, with a powerful monetary place with round $ 95 million in property

Uniswap additionally recommends a market share of 67% beneath decentralized festivals (DEXS) on Ethereum. Nonetheless, the momentum is confronted with new authorized headwind, as a result of rival protocol Bancor has imposed a lawsuit, escalating tensions throughout the automated market maker (AMM) house.

Secure monetary place

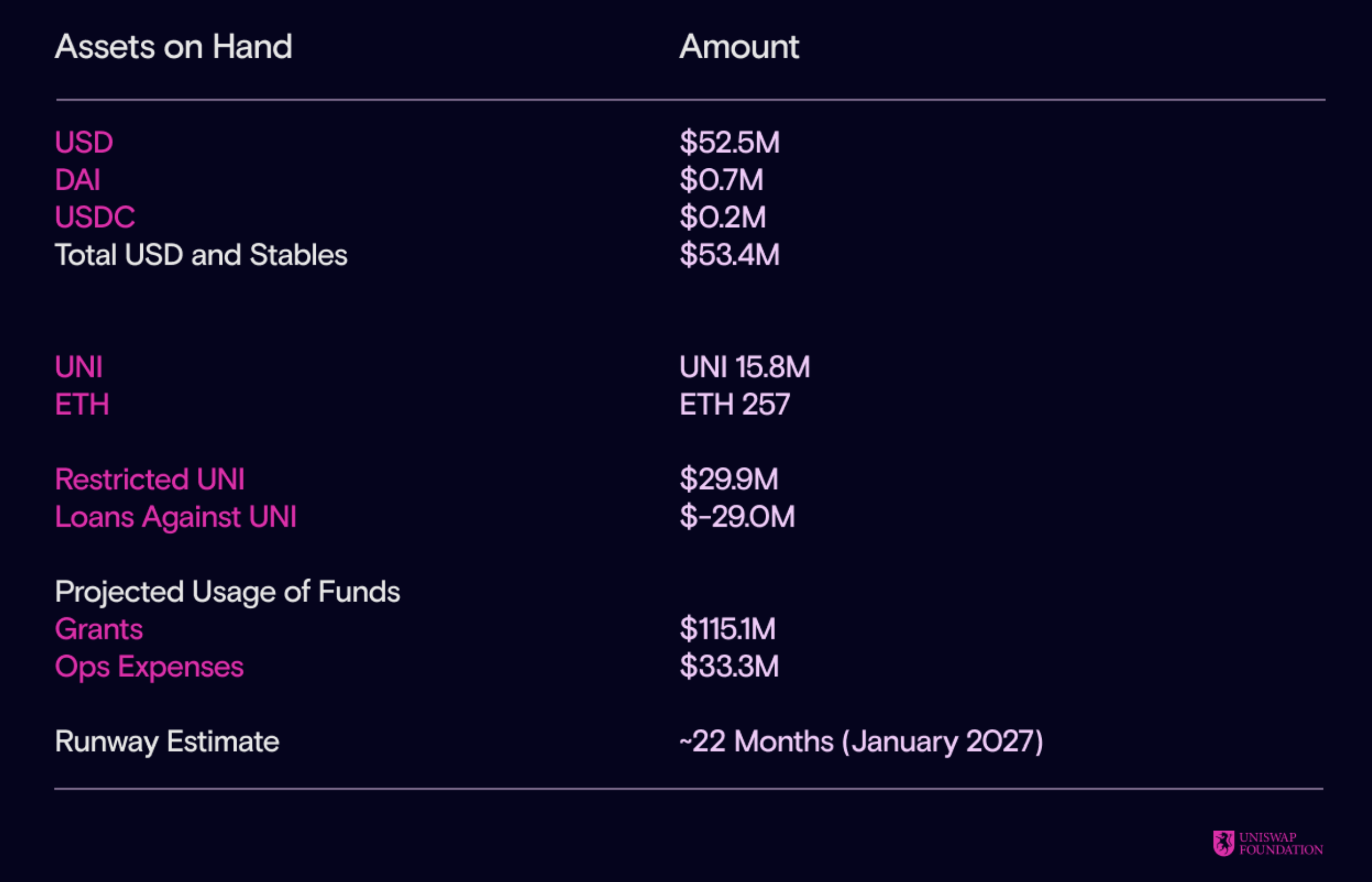

As of March 31, 2025, the Uniswap Basis has assigned $ 115.1 million for subsidies and operational actions, which ensures sustainability till January 2027. The report signifies that Uniswap $ 53.4 million in money and stablecoins, 15.8 million uni -tokens and 257. Tokens and 257.

Uniswap Basis Q1 2025 Financials. Supply: Uniswap Basis

It’s outstanding that Uniswap has used 5 million Uni -Tokens to borrow $ 29 million by means of a monetary instrument that ensures USD -Liquidity with out considerably influencing the market, whereas the collateral is protected and retains the upward potential.

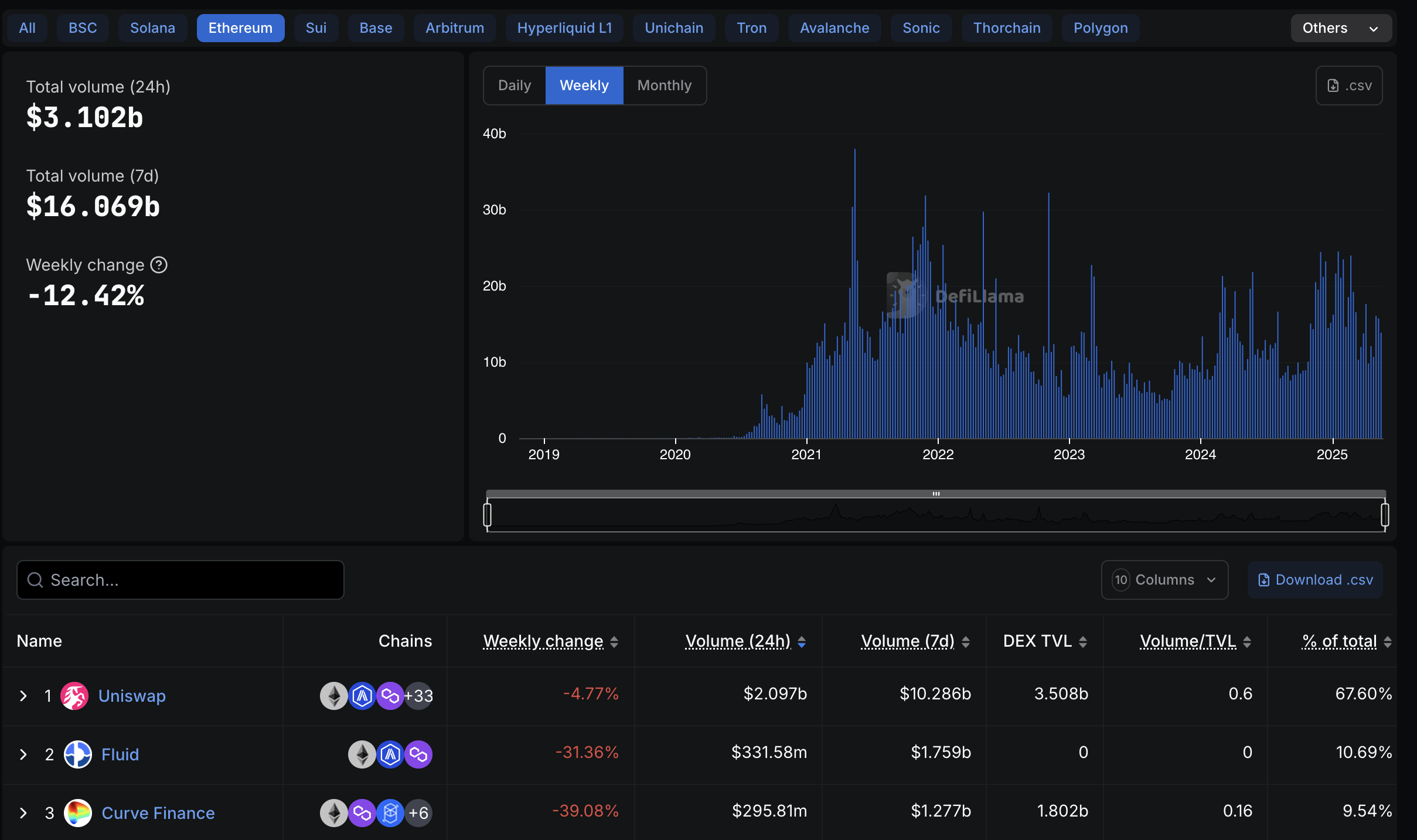

This monetary stability corresponds to the dominance of Uniswap within the Ethereum Dex market. Information on the chains exhibits that the entire quantity on Ethereum Dexs is $ 16 billion for seven days. Uniswap accounts for greater than 67.6% of the market share, with a weekly commerce quantity of $ 10 billion.

Earlier, as Beincrypto reported, Uniswap $ 3 tips within the complete commerce quantity, he used $ 3.6 billion in day by day transactions and secured 24% of the worldwide DEX quantity.

Uniswap market share. Supply: Defillama

This exhibits that Uniswap is your best option for particular person merchants and a trusted platform for establishments, due to the excessive liquidity and person -friendly interface. This development additionally displays the pattern of traders who return to Defi, particularly within the midst of the sturdy restoration of ETH and Altcoin costs in mid-2025.

Authorized challenges

After the lawsuit with the SEC, Uniswap just lately stood for Bancor’s authorized challenges, a competitor within the automated market maker (AMM) house. Bancor has sued Uniswap and claims that infringement on the patent and claims that Uniswap used his know-how with out permission.

“As innovators and inventors, the safety of our mental property is of basic significance for the well being of the ecosystem. If firms corresponding to Uniswap can act with no consequence, we worry that it’ll hinder innovation all through the trade on the expense of all Defi gamers.” Mark Richardson, undertaking supervisor at Bancor, observed.

In response, Uniswap rejected the allegations, referred to as them an “costly distraction” and guarantees to defend his rights. This lawsuit might affect the status of Uniswap and might enhance authorized prices, however with its monetary assets the group is nicely outfitted to tackle these challenges and to proceed its development.

Regardless of these challenges, Uniswap continues to strengthen its management within the Defi house. The 67% market share on Ethereum Dexs is an effective outcome for the attraction of the platform. To keep up its place, nevertheless, Uniswap should successfully navigate authorized issues, the launch of Unichain L2 and rising competitors from rivals corresponding to pancake wap and curve financing.