Argentina’s trip to Cryptocurrency took a dramatic turn in February 2025 when President Javier Milei tweeted to support scales, one Solana-Based meme coin. Within a few hours, Libra crashed nearly 90%, causing accusations of fraud and to call to action for the accusation of Milei.

Under the external entities involved in the launch of Libra were Culier Ventures, led by CEO Hayden Davis; Chicken protocol, led by CEO Julian Peh; And on Solana-based Meteora platform, which had previously facilitated launches for both the meme coins of Donald and Melania Trump.

After the collapse of Libra, the stock market in Argentina fell by more than 5% at the opening on 17 February 2025. This article will investigate Libra and the scandal around the latest Muntcoin -Rage.

What is Weegra?

The scales of scales, made by the Viva La Libertad Projectwas promoted as a financing instrument for small companies and innovative projects of Argentina – an unusual use case for a meme coin, which are usually powered by internet phenomena, celebrities and humor.

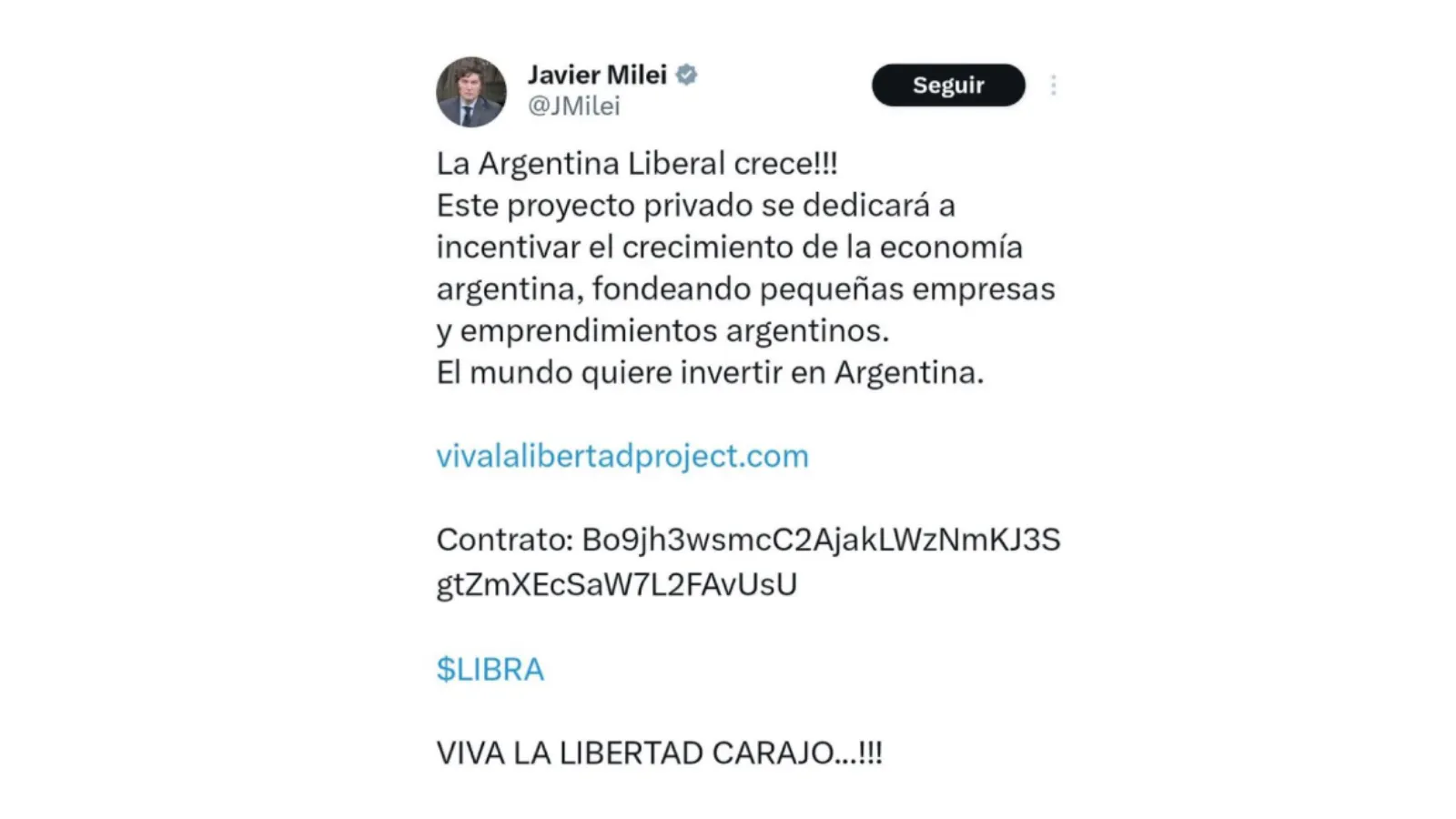

“This private project will be dedicated to encouraging the growth of the Argentinian economy by financing small Argentinian companies and startups,” said Milei in a post -removed post with the project website and contract address. Milei then denied any prior knowledge of the Libra project.

Libra has a maximum stock of 1 billion tokens. According to the Libertad Project website, the distribution of Libra -token would split 50% into the growth of Argentina, 20% into treasury and 30% for liquidity.

On February 17, 2025, the token reached a record high of $ 0.75, according to Coentecko facts. At the time, the market capitalization of scales had reached $ 4.5 billion. Hours later it fell sharply, activating fraud investigation and accused calls against Milei.

In May 2025, Milei closed an investigation task to set up to look at potential misconduct; A month later, the anti-corruption unit of the country cleared the president about his involvement in the scales, which stated that he acted on a personal capacity in tweeting about the project. From June 2025 a federal criminal probe is still underway in the affair.

Did you know that?

The Solana -based meme coin scales, although it shares its name with the original name of Facebook’s abortive attempt at a digital currency (subsequently renamed Diem) has no ties with that project.

A short timeline of events: the scales -topping scandal

On February 15, 2025, the President’s office gave a timeline of Early events Related to the creation and launch of the Libra Meme Munt.

October 19, 2024 – First meeting with chicken protocol

- The President’s office reported That President Javier Milei met representatives of the chicken protocol in Argentina.

- The representatives informed Milei about their intention to develop a project called “Viva La Libertad” using blockchain technology to finance private companies in Argentina.

January 30, 2025 – Meeting with Hayden Mark Davis

- President Milei held a meeting in Casa Rosada with Hayden Mark Davis.

- According to Chicken Protocol representatives, Davis would offer the technological infrastructure for the project.

- The President’s office clarified that Davis was not a previous connection with the Argentinian government and was presented as a partner of Kip protocol.

February 17, 2025 – The rise and fall of scales

- Milei promotes scales: Argentina’s President Javier Milei announced the launch of the Solana-based meme Coin Libra, who was promoted as a way to finance small businesses and startups.

- Pre-launch Insider activity: According to one report Through TRM Labs, 20 minutes before Milei’s announcement, an address received 1 million $ Weighing scale and added to a Meteora Liquidity pool.

- All time high: Libra reaches $ 0.75, which gives it a market capitalization of $ 4.5 billion.

- Rapid decline: The price crashed almost 90%within a few hours, which activated accusations of fraud and a pump and dump scheme.

- Liquidity confidence: Wallets linked to the Libra team raised $ 7.8 million in Sol, which contributed to the collapse of the price.

February 18, 2025 – The Fallout starts

- The stock market of Argentina fell more than 5% at the opening in Buenos Aires, which contributed to financial instability.

- Milei removed his function to promote Libra and denied prior knowledge of the project, since a judge was assigned to lead a probe in accusations of fraud.

- Investors accused chicken protocol and his CEO, Julian Peh, Cheosier Ventures and his CEO, Hayden Davis, Mauricio Novelli and Manuel Godoy of the Tech Forum Argentina of miserable behavior in the scandal.

Allegations of prior knowledge trade

Experts suspect that the scales -token has collapsed due to insider activity. According to the analysis company TRM Labs, 20 minutes before the tweet of President Milei, one address was received, according to the San Francisco 1 million Libute scales, she added to a Meteora Liquidity pool and spread more about other addresses that did the same.

Shortly thereafter, on-chain research agency Bubblemaps identified Those portfolios that were related to the Libra team had included $ 87 million in Sol from the Pole, so that the price of Libra was gradually crashed.

In addition to accusations of fraud against Milei, investors accused Chicken Protocol and its CEO, Julian Peh, Chessier Ventures and his CEO, Hayden Davis, Mauricio Novelli and Manuel Godoy of the Tech Forum Argentina of misconduct in the scales scandal.

On February 17, 2025, Davis told Barstool Sports -founder Dave Portnoy that Davis “was at $ 100 million” after the launch of Libra – which fed the controversy. Davis claimed that he was not going to run away with the money.

“It’s not mine,” said Davis. “It’s from Argentina.”

That same day, analysis revealed on the chain that the Meteora-based platform known to create the meme coins of Trump and Melania was also behind the scales of token. After the collapse of scales and emerging accusations of prior knowledge trade, co-founder of Meteora Ben Chow resigned.

A month later, the Argentinian lawyer Gregorio Dalbon formally sought the international detention of Davis; From June 2025 Interpol has to approve a red notification.

In one tweet,, Solana-based Exchange Jupiter said that the launch of Libra had been an “open secret” in Meme Coin circles. The exchange said it was not evidence of trade with prior knowledge or “sniping” by his own team members after an internal investigation, and added that the company takes claims from trade with prior knowledge “extremely serious”.

On $ Libra

Since the start, Jupiter has always placed a huge premium on transparency. The Memecoin Launch Game is a dirty game with a lot of ugly behavior. However, we have nothing to hide.

So here the facts are as clear as we can say them.

A few members of the …

– Jupiter (🐱, 🐐) (@jupiterexchange) February 16, 2025

“The Memecoin Launch Game is a dirty game with a lot of ugly behavior,” Jupiter wrote. “However, we have nothing to hide.”

“We were completely unaware of the transactions between the clients, in this case Milei and the market makers, and were in no way involved, form or form,” Jupiter added.

By one report By Nansen, only 14% made Libra investors profit and jointly earned $ 180 million from the launch of the token, while 86% of those who invested in Libra lost $ 251 million.

In particular, per details of Nansen, have two portfolios that bought $ scale at 22:01 UTC and sold against 22:44 UTC on 14 February collective $ 5.4 million, with one wallet, HyzGO2, with $ 5.1 million. In the meantime, Barrstool Sports founder Dave Portnoy lost $ 6.3 million by investing in scales, but later $ 5 million was repaid.

This article was published in February 2025 and updated in June 2025.

Daily debrief Newsletter

Start every day with the top news stories at the moment, plus original functions, a podcast, videos and more.