The cryptomarkt has hit raw waters and causes widespread sale and massive liquidations. According to CoinglassThe company alone saw $ 458.61 million liquidated in the last 24 hours. Ethereum was the most difficult affected, good for $ 170.78 million in liquidations, of which $ 157.03 million of long positions and $ 13.75 million from shorts. This emphasizes the growing uncertainty and volatility, which makes traders on the cliff and the short -term price unclear. However, this ETH price analysis is derived from deleting all fog.

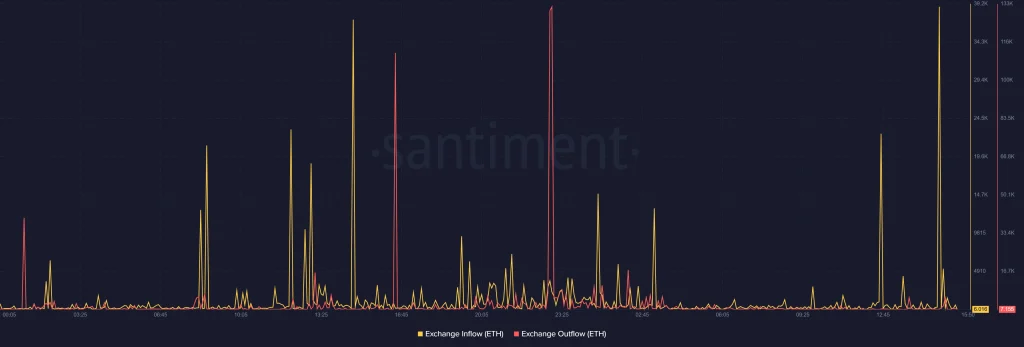

Exchange intake Spike:

Data about chains from Santiment A bearish photo. ETH flows in centralized exchanges in an unusually high percentage, far apart. This increase usually indicates that holders are preparing to sell, which matches the liquidation wave that just touches Ethereum. The size of this intake implies panic sales or aggressive profitable.

From a technical point of view, the RSI of ETH is at 40.29, which floats just above the sold -over territory, which can suggest a bounce in the short term. To support this, the 4-hour graph shows that ETH is back the Lower Bollinger band for $ 2,371, which forms a bullish hammer-like candle, which signals buyer support at lower levels.

However, ETH remains under the SMA with 20 periods, which reflects a Barisish Momentum. For a recovery, Bulls must regain the resistance of $ 2,495. If this level does not hold, ETH could again test the $ 2,400 support zone.

Read our Ethereum (ETH) Price forecast 2025, 2026-2030 for long-term goals!

FAQs

The price dip of Ethereum is mainly powered by increased liquidations and heavy inflow to exchange.

Caution is required for traders, while ETH shows signs of buyer support in the short term, keeping technical means Beerarish and the influx of the exchange is high, hints for more volatility.

The most important support is at $ 2,400, while the resistance is near $ 2,495.