Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

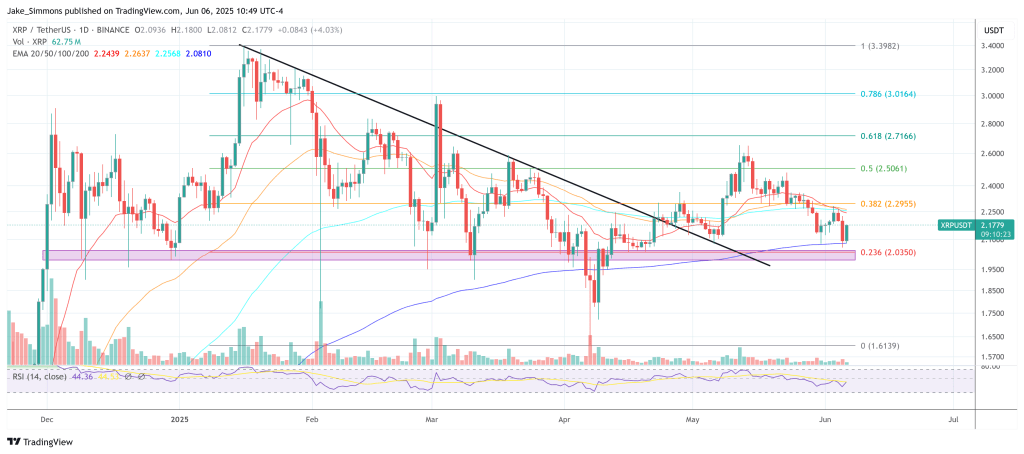

Crypto Insight UK has doubled with a prediction that XRP should pass a last, violent shake -out before it is launched to a long -awaited milestone of $ 10. In his newest video, the British analyst warned that “the most dense liquidity I have seen in the current spot. Until that Pole is swept, he argues, the market will not unlock the upward movement that he ultimately expects to take the token to a double -digit territory.

XRP needs one last flush

“XRP did not come as low as we wanted,” he told Viewers. “It achieved the first key area of liquidity, but it didn’t cost it all. That reminds me that we went further.” In his own trading plan, the analyst has a rest bids at around $ 2.01 and $ 1.95 – a zone that he thinks will be tested as soon as the lung capitulate. Only after that ‘final flush’, he claims, can a meeting to $ 10 seriously begin.

The call comes in the midst of a wider cross-asset power that has not been translated into a persistent Altcoin outbreak so far. Silver challenges ten-year-old highlights from almost $ 36 per ounce, uranium contracts press on their recent peaks and the Nasdaq composite remains in the sight of his all time. But despite what he calls ‘a broad raw material rally’, the analyst claims that Crypto still needs a leaching to erase the remaining excess.

Related lecture

Macro-politics drama, he suggests, only speeds up that process. He quoted the public collision between Elon Musk and the US President Donald Trump-Sparkled by Trump’s proposal for an expenditure account of four trillion dollars and the claim of Musk that the name of Trump appears in sealed Epstein files and a story that briefly rattled the risk market. “If it brings the price to where I want it to go, fantastic,” he said dry. “That’s all we’re looking at here.”

He sees a similar dynamic at Ethereum. Open interest in Eth-Futures remains high all time, a sign in his opinion that institutions collect the place while they shorten derivatives to cover themselves-a trade that could be relaxed violently, could pierce the level of $ 2,800. “If we squeeze this upward squeeze,” he predicted, “we will see a quick movement to all time for ETH, probably to $ 4,500 before you know it.”

Related lecture

Bitcoin, for his part, is already in the preferred liquidity zone of the analysts just more than $ 100,000 robes. Whether it needs a different dip, he said, he said, is less important than what happens to his dominance. A brief increase in the market share from Bitcoin to 65.5% would coincide in his model with an XRP capitulation and form the stage for ‘Crazy Season’, Steno for a full Altcoin cycle.

The hinge is XRP liquidity. Viewers were shown snapshots with heat folder that emphasize concentrated stop-loss orders under the May Swing Low. ‘People came here long after they thought:’ Oh, the bottom is in. “That has been added to this liquidity among us,” he said. Until that low is removed, it remains “80% sure” that the price will investigate – although his own portfolio is almost completely in spot XRP. “I am on the side of wanting to go,” he acknowledged. “If it goes up now, I’m happy. But I would be very surprised if we didn’t get that push down.”

Yet his end point is unambiguously bullish. Once the liquidity has been harvested, he provides a bullish divergence of the textbook on the daily relative strength index-“lower low price, higher low on RSI” that would ignite what he calls the “next big push”. In that scenario, XRP would not only look at his 2021 peak near $ 3.80; It would exceed the long -term goal of $ 10 of the analyst. “Let it send,” he concluded.

At the time of the press, XRP traded at $ 2.17.

Featured image made with dall.e, graph of tradingview.com